Naver Pay app installations soared 186 percent to 470,000 in April, a month after it integrated its payment service with Samsung Pay, according to Naver Financial.

"We see that the number of app installations for Samsung Pay's interlinked offline payment service has significantly increased,” a Naver Financial official said in a statement Thursday.

"The usage of the payment service has expanded to include a wider range of locations, encompassing not only convenience stores and franchise outlets but also small-scale businesses such as hospitals, clinics, pharmacies, local restaurants and gas stations.”

Naver Financial, an operating subsidiary of the internet giant, said the average offline payment amount per user also jumped 123 percent compared to the figure in March. Also, users who made two or more offline payments using Naver Pay accounted for 72 percent of the total in April.

By age, offline payments by people in their 30s and 40s increased by 206 percent and 219 percent, respectively, in April, compared to the previous month. Expenses for users in their 20s also increased by 143 percent.

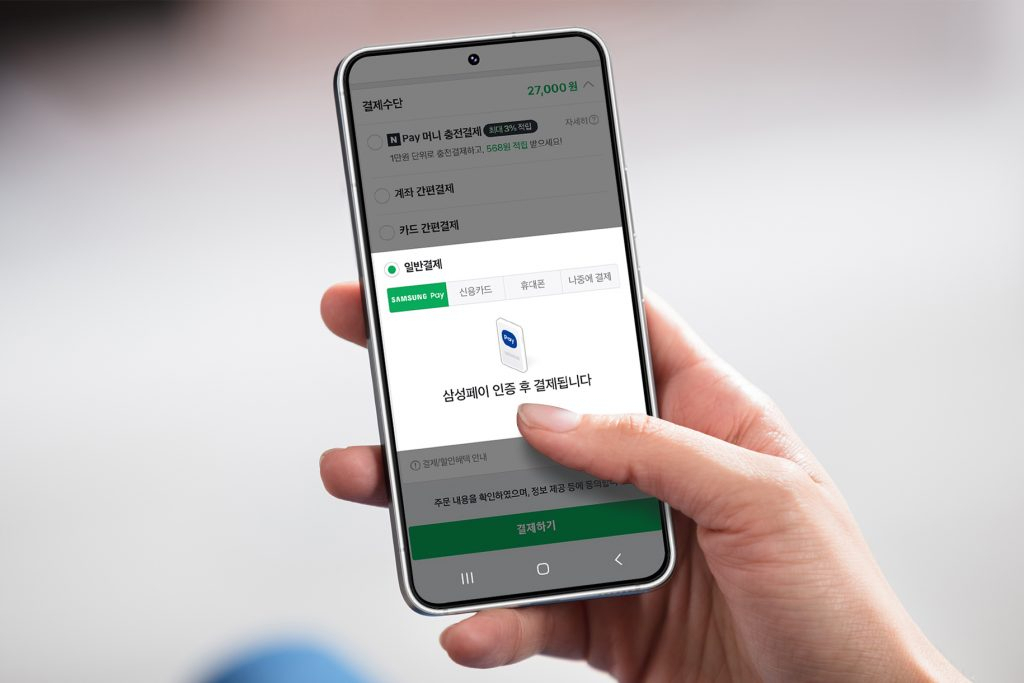

The Samsung-Naver alliance has been seen as a strategy to solidify Samsung's leading position in the digital wallet market in Korea. It launched on March 23, a day after Apple Pay's entry into the market.

Samsung Pay's payment service market share was 23.5 percent in the first half of last year in terms of users’ transactions. It also accounted for about 80 percent of all offline digital payment transactions.

Nonetheless, Apple Pay is still the most used payment solution globally, with Samsung Pay a distant third.

The partnership between Samsung and Naver enabled a whopping 31.5 million Naver Pay members to make payments with their smartphones at any store that accepts credit card payments, using a magnetic secure transmission system.

Likewise, it also enabled Samsung Pay users to make transactions at over 550,000 Naver Pay-affiliated online stores.

Samsung Pay has also signed a partnership deal with Kakao Pay, the online payment unit of tech giant Kakao Corp. -- which had more than 40 percent market share in the first half of last year.

“While the interlink with Samsung Pay is currently under discussion, nothing has been decided yet,” Baek Seung-jun, the business general manager of Kakao Pay, said during a press conference held on Monday.

Meanwhile, Hyundai Card, Apple Pay's partner in South Korea, saw a 75 percent on-month increase in the number of new card users after the payment service launched in Korea.

The number of new Hyundai Card members increased by 203,000, following the launch of Apple Pay in Korea, according to data from the Credit Finance Association of Korea. This figure was the highest among eight local credit card companies -- Lotte, BC, Samsung, Shinhan, Woori, Hana, Hyundai and KB Kookmin Card.