Woori Financial Group said Monday it has closed a deal to acquire Tongyang Asset Management and ABL Global Asset Management, marking its first acquisition deal since the group’s adoption of a holding company structure earlier this year.

Woori Financial signed a stock purchase agreement with China’s Anbang Insurance Group to acquire its two asset management subsidiaries, closing a deal that is expected to help the group expand its nonbanking business segment.

The deal comes around three months after the launch of Woori Financial Holdings on Jan. 11. It marks the start of the group’s pledge to expand its nonbanking business segment through strategic M&As and to expand its scope beyond its main banking business led by Woori Bank.

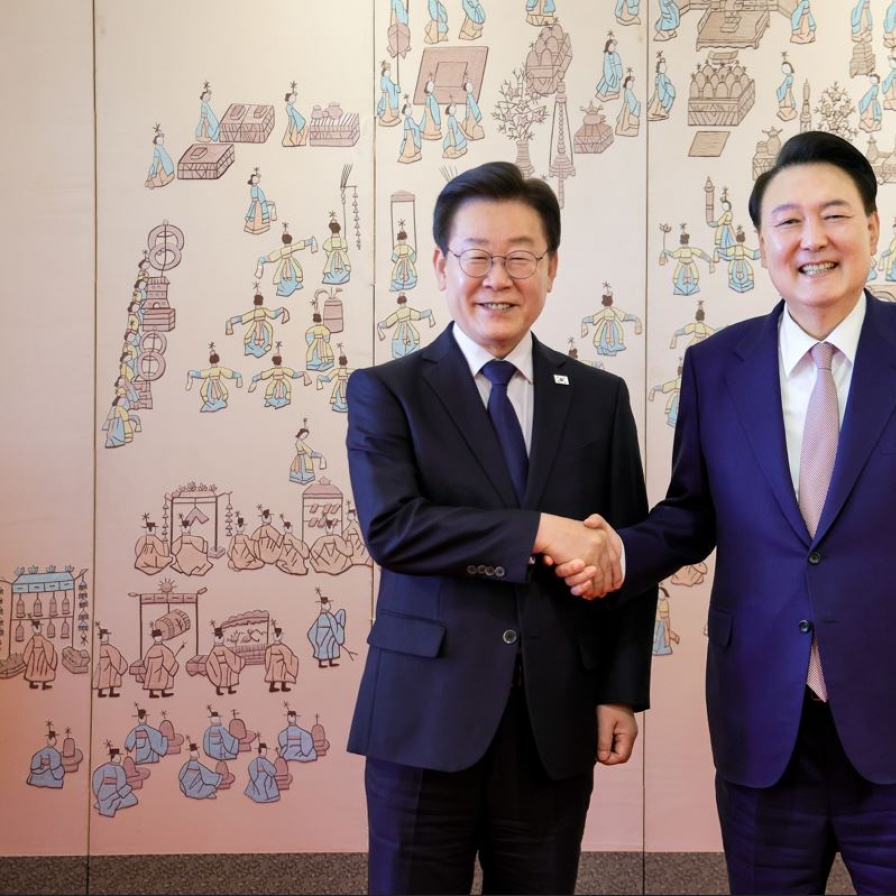

Woori Financial Group Chairman Sohn Tae-seung (right) and Tongyang Life CEO Luo Jianrong pose after signing a stock purchase agreement on Monday. (Woori Financial Group)

Woori disclosed that it had purchased Tongyang Asset Management for 123 billion won ($176 million). The purchase price of ABL Global Asset Management was not subject to public disclosure.

Launched in 2000, Tongyang Asset Management and ABL Global Asset Management respectively came in 13th and 29th domestically in terms of the size of assets under management, or AUM, as of end-2018. Woori now hopes to expand its presence to become one of the global top five firms in the industry, it said.

Woori took off under a holding company structure earlier this year, with Chairman Sohn Tae-seung pledging initial focus on acquiring small asset management firms, real estate investment trusts and savings banks.

The banking group plans to pursue larger M&A opportunities -- of securities and life insurance companies -- in the future, as it is obliged to maintain a set capital adequacy ratio and therefore has limits on capital usage for now.

With well-chosen acquisitions, Woori Financial Group’s goal is to bring its banking-to-nonbanking business ratio to 7:3 and eventually to 6:4, enabling Woori to diversify its profits beyond traditional banking services, according to the chairman.

As of end-2018, Woori Bank accounted for 97 percent of Woori Financial’s assets and 93 percent of the group’s total net profit.

“Starting with the acquisition of asset management firms, we will continue our expansion into the nonbanking segment by acquiring real estate trusts, capital firms, savings banks, securities firms and insurance firms,” Sohn said in a statement Monday.

In addition to the two asset management firms at hand, Woori is close to acquiring Kukje Asset Trust, a family-owned real asset trust company. The two sides signed a memorandum of understanding on April 3, agreeing to take steps to conclude a stock purchase deal.

Founded in 2007, Kukje Trust logged 31.5 billion won in net profit last year. Its AUM stands at 23.6 trillion won, the ninth-largest out of 11 domestic realty asset management firms. Woori is set to acquire a 65.7 percent majority stake in the trust for around 150 billion won, according to market projections.

Moreover, Woori has the option of exercising its right of first refusal to purchase more shares in Aju Capital and acquire its wholly owned subsidiary Aju Savings Bank.

By Sohn Ji-young (

jys@heraldcorp.com)

![[Herald Interview] Mom’s Touch seeks to replicate success in Japan](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/29/20240429050568_0.jpg&u=)