South Korean stocks ended almost flat Thursday thanks to gains in techs and autos despite higher-than-expected US inflation that dimmed hopes for the Federal Reserve's early rate cuts. The Korean won sharply fell to the lowest point in 17 months against the US dollar.

After starting 1.45 percent lower, the benchmark Korea Composite Stock Price Index pared earlier losses by rising 1.8 points, or 0.07 percent, to close at 2,706.96.

Trade volume was moderate at 522.4 million shares worth 12.5 trillion won ($9.16 billion), with decliners outpacing gainers 606 to 270.

Retail and foreign investors bought local shares worth 43.8 billion won and 1.02 trillion won, respectively, offsetting institution's stock selling valued at 1.08 trillion won.

Overnight, Wall Street lost ground as the release of a key measure of inflation dashed investors' bets that the Federal Reserve may start cutting its rates soon.

The US consumer price index for March, which excludes food and energy costs, increased 0.4 percent from February, more than the expected 0.3 percent rise, showing that inflation is still elevated.

After the release of the CPI report, many economists pulled back expectations the Fed will start cutting its rates in June.

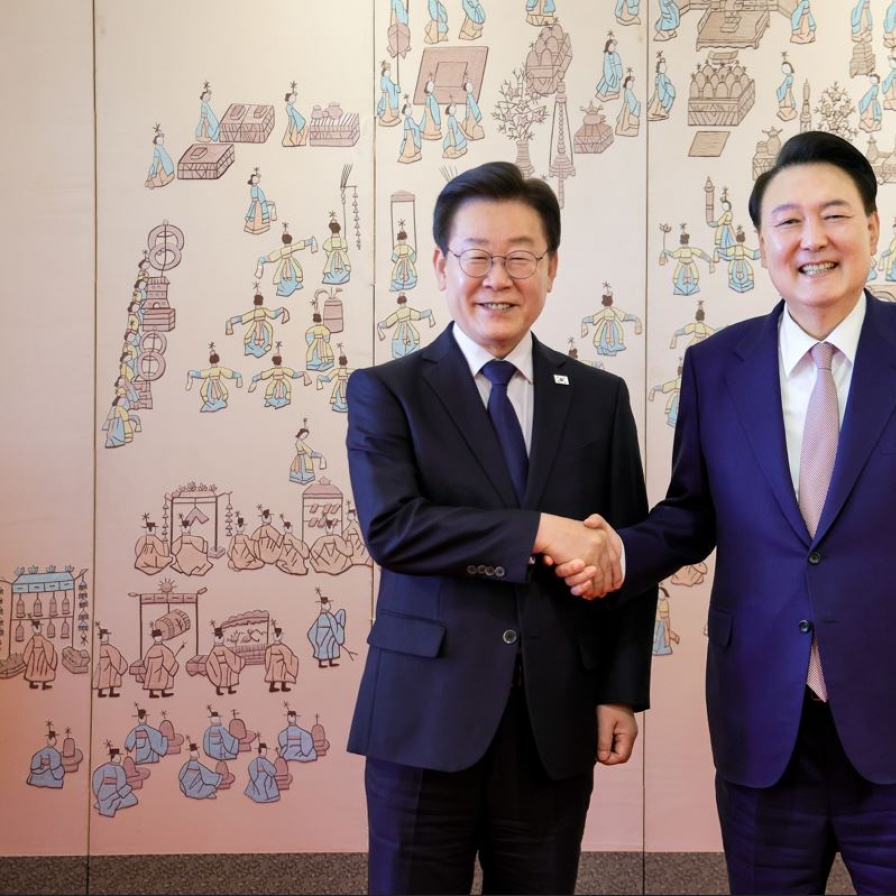

Also, political uncertainties have eased to some degree after the general elections as the country's opposition bloc captured nearly 200 of the 300 seats in the National Assembly.

"The Kospi started in a negative note due to impact from the overnight US market, but semiconductor shares saved the day," Kim Seok-hwan, an analyst at Mirae Asset Securities, said.

Foreigners seem to have expectations on chip performance considering the South Korean government's investment plan for the semiconductor industry and upbeat quarterly revenue from Taiwanese chip giant TSMC, Kim added.

In Seoul, chipmakers and automakers gained ground.

Market bellwether Samsung Electronics rose 0.6 percent to 84,100 won, and No. 2 chipmaker SK hynix jumped 3.01 percent to 188,400 won.

Hanmi Semiconductor surged 6.62 percent on news it has secured a deal to supply chip-making equipment to Micron Technology.

Top automaker Hyundai Motor shot up 5.7 percent to 241,000 won, and its smaller affiliate Kia advanced 3.43 percent to 111,700 won.

Hyundai Mobis, an auto parts making affiliate of Hyundai Motor, also climbed 3.29 percent to 251,000 won.

Battery shares were mixed. Leader LG Energy Solution moved up 1.6 percent to 380,000 won and Posco Future M 0.89 percent to 282,500 won, but Samsung SDI dropped 0.85 percent to 407,500 won.

IT and financial shares went south.

Internet portal operator Naver sank 2.86 percent to 183,600 won, and Kakao, the operator of the country's top mobile messenger, slid 2.44 percent to 48,050 won.

KB Financial Group and Shinhan Financial Group both lost more than 1.1 percent to close at 68,300 won and 43,100 won, respectively. Samsung Life Insurance plunged 5.03 percent to 85,000 won.

The local currency ended at 1,364.10 won against the greenback, down 9.20 won from the previous session's close, marking the lowest since November 10, when the won closed at 1,378.5 to the greenback.

Bond prices, which move inversely to yields, decreased. The yield on three-year Treasurys rose 7.5 basis points to 3.466 percent, and the return on the benchmark five-year government bonds also gained 7.5 basis points to 3.511 percent. (Yonhap)

![[Herald Interview] Mom’s Touch seeks to replicate success in Japan](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/29/20240429050568_0.jpg&u=)