Hyundai Motor Group pulled in an all-time high annual operating profit of 26.7 trillion won ($20 billion) last year, outpacing Samsung Electronics, which held the No. 1 position among the listed companies in Korea for 14 consecutive years, for the first time.

Hyundai Motor Company saw a 15.1 trillion won record profit in 2023, a 54 percent jump from the earlier year with a 9.3 percent operating profit margin, while its sales revenue surged 14.4 percent to 162.7 trillion won, the company’s earnings report showed Thursday.

Its smaller sibling Kia’s profit and revenue reached new heights, increasing 60.5 percent and 15.3 percent to 11.6 trillion won and 99.8 trillion won, respectively. Its operating margin came to 11.6 percent. It is the first time the company recorded double-digit figures in both operating profit and margin.

In terms of operating profit, Hyundai Motor and Kia ranked first and second. Samsung Electronics came third, posting 6.54 trillion won in profit, a 35 percent drop compared to the same period last year.

Some experts say the shift in industries in recent years has allowed the third-largest car manufacturer to make history by beating one of the world’s biggest chipmakers.

“At the peak of COVID-19, Samsung enjoyed a surge in sales of memory chips buoyed by the burgeoning IT sector that enabled noncontact businesses. But with ‘return-to-normalcy,’ opened a new chapter for the automotive industry,” said Lee Ho-geun, a car engineering professor at Daeduk University. “Hyundai took the opportunity and boosted sales of profitable car models.”

Lee stressed that it is a major triumph for Hyundai Motor Group given the history with the archrival Samsung Electronics that started long before the era of the current leadership under Chung Euisun and Lee Jae-yong.

Hyundai Motor’s late founder Chung Ju-yung started the semiconductor business in the 1980s and competed head-on with Samsung Group’s late founder Lee Byung-chull. The two conglomerates also clashed over the automotive business when the late Samsung Group Chairman Lee Kun-hee launched Samsung Motors in 1995.

The third-generation chaebol leaders have changed the tides, joining forces in in-car display and automotive chips, but the rivalry is set to continue, Lee said.

“Hyundai Motor could be on a stronger footing for the next five to six years than Samsung. But if the chip giant enters the electric vehicle and autonomous driving business like Apple, it might have an upper hand because the future mobility will be ‘computers on wheels.’”

In its earnings release, Hyundai Motor said that last year’s stellar performance was largely driven by a surge in sales of profitable car lineups -- sport utility vehicles, recreational vehicles as well as its premium brand Genesis cars.

Expanding footing in key global markets, it posted an all-time high record in the US, selling more than 1.6 million cars in the US, a 12.1 percent increase compared to 2022. Sales of eco-friendly cars including EVs, in particular, skyrocketed by 52.3 percent to 278,122 units.

Kia said it witnessed strong sales with an improved product portfolio of adding more profitable SUVs and a steep drop in materials cost. It also saw sales growth in leading automotive markets -- 782,000 units in the US and 572,000 units in Europe.

Last year, Hyundai Motor sold around 4.2 million units -- 762,077 units in the domestic market and 3.4 million units in global markets, up 6.9 percent on-year. Kia set a record, selling 3.1 million units -- 563,660 units here and 2.5 million units abroad.

As for this year’s business plan, Hyundai Motor and Kia aim to sell more than 7.4 million units at home and overseas, up 1.9 percent from the combined sales in 2023. For global sales, Hyundai and Kia each set sales targets of 3.5 million and 2.7 million units, accounting for 83.3 percent of the total sales.

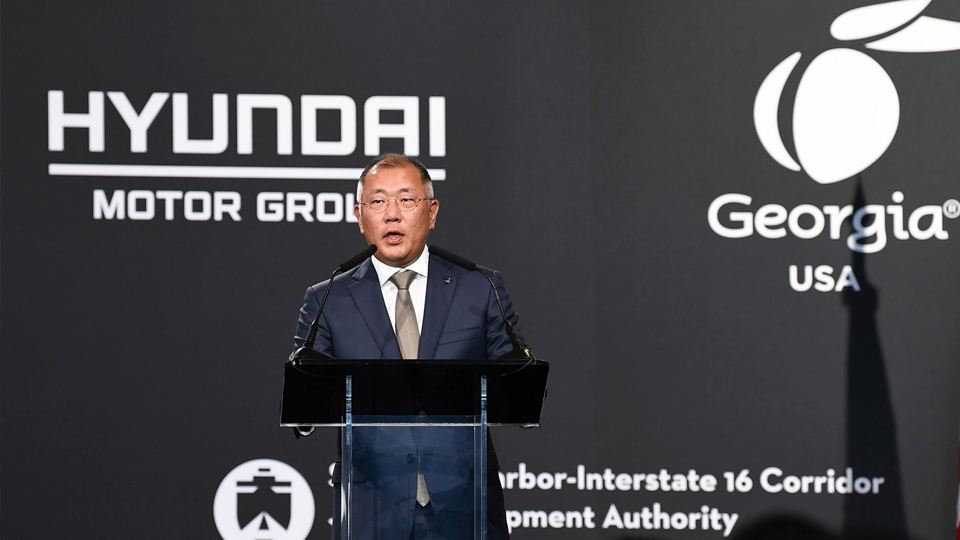

Hyundai Motor set an annual guidance of 4-5 percent and 8-9 percent increase in revenue and operating profit margin. It plans to inject 12.4 trillion won into building an EV manufacturing plant in the US state of Georgia, research and development and capital expenditure.

Despite a slight downward trend in EV sales, the carmaker aims to sell 300,000 battery-powered cars in 2024, a 12 percent increase from last year. Sales of hybrid vehicles are projected to grow by 29.7 percent to 480,000 units.

In response to the industry’s concerns over the hefty incentives handed out to car leasing customers, it will continue to reduce the incentives for internal combustion engine cars to control the overall cost and improve profitability. Hyundai Motor is carrying out a separate incentive policy because its cars are ineligible for the US tax credits under the Inflation Reduction Act.

Kia pledged to increase annual sales revenue and operating profit by 1.3 percent and 3.4 percent to 101.1 trillion won and 12 trillion won. It set a higher target of an operating margin of 11.9 percent.

The company plans to create a strong foothold in global EV markets, which are projected to show approximately 50 percent growth in sales this year, by accelerating sales of the large-sized electric SUV EV9 in North America and Europe. Starting with the smaller EV3, slated for market debut in June, it said the new electric car lineups including the EV4 and EV5 will be “volume zone” models that would balance the price competitiveness and profitability.

Noting that it is witnessing rising demand for hybrid cars, Kia said its hybrid sales are expected to increase by 20-25 percent after adding new models to its lineup, including the Seltos Hybrid.

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)