(GettyimageBank)

For automakers in Korea, there is no sign the prolonged automotive semiconductor shortage will abate this year. Those who have purchased a new Genesis, for instance, have been notified that the car will take six to 12 months to be delivered –- if they are lucky. GM Korea’s second Buypeong plant in Incheon cut production volume by half earlier this month.

And according to the market, this delay in car production due to the chip shortage may continue in the next year or even the year after.

Experts say the main cause of the chip shortage is that not just the pandemic-triggered supply disruption, but also poor judgement by automakers in forecasting the demand.

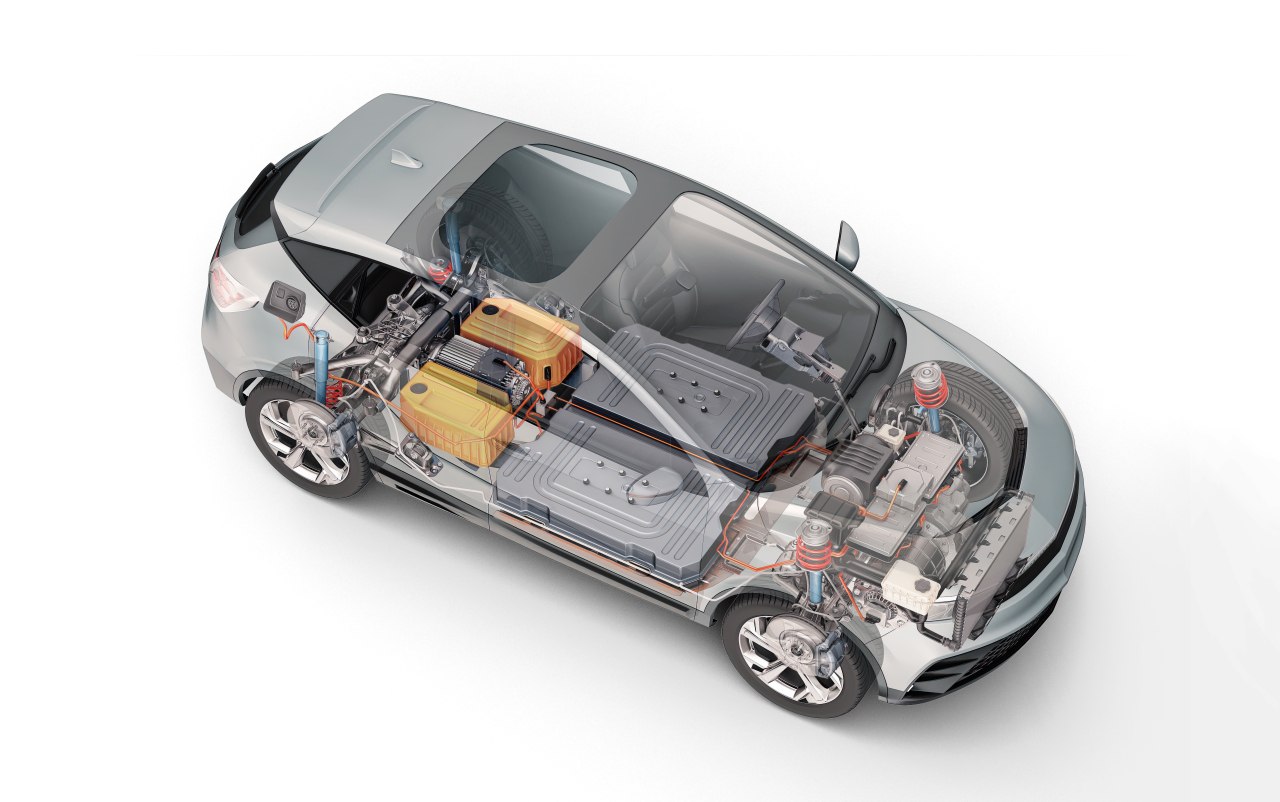

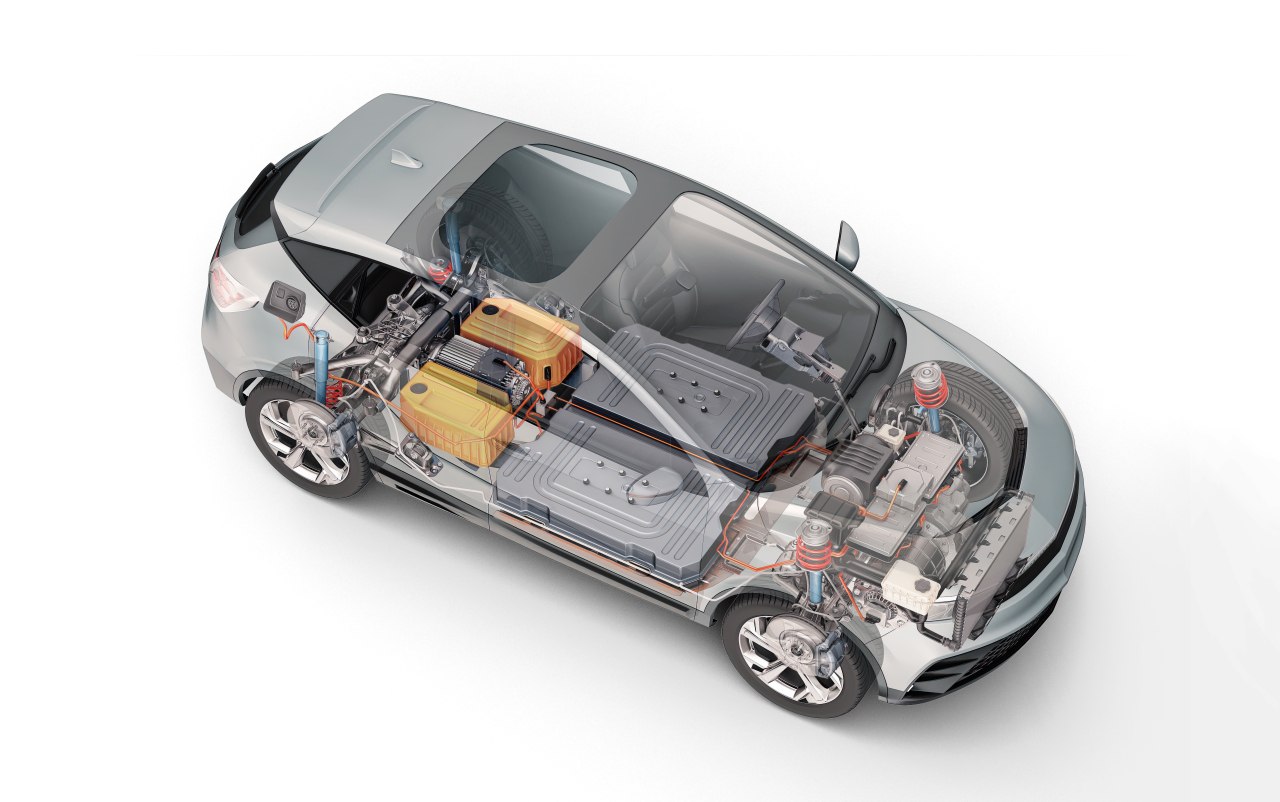

Automotive chips control all the IT systems inside a car. Unlike memory semiconductors, which are responsible for storage of data, automotive semiconductors operate systems. The micro controller unit (MCU) is equivalent to a human brain as it controls the electronic system of a car, while an analog circuit turns speed, pressure and temperature into digital signals -- both rely on semiconductors to function.

And the number of these semiconductors that companies have ordered significantly dropped in late 2020. Carmakers predicted the outbreak of the coronavirus in March 2020 would pull down overall automotive sales and made fewer orders to match production expectations. So the chipmakers shifted their focus to producing more chips for mobile devices and PCs.

However, market demand for cars bounced back relatively quickly, especially as countries unveiled so-called "living with COVID-19" policies in early 2021 to invigorate spending with the ultra-low interest rate. Urgent orders from carmakers only paralyzed the market.

Automated robot arms work at an assembly line at an automotive manufacturing plant. (Gettyimage Bank)

The way the automotive chips are built is another reason for the continued domino effect from auto chip shortages.

Global carmakers’ chips are produced in a so-called “Just In Time” method. Firms like Toyota have taken to purchasing a fixed amount of a certain type of chip from time to time to increase efficiency of manufacturing operation and to streamline the auto parts they need. This inventory management system has been learned by many other carmakers and settled as the global standard.

But according to those in the semiconductor industry, this approach doesn’t fit well with the characteristics of semiconductor production.

“Semiconductors require an average of six months of lead time, a duration it takes from the day a contract for production is signed to the final delivery date. Due to the monthslong production lead time, chip manufacturers cannot immediately respond to market demand and produce a large volume at once,” said Kim Pil-soo, professor of automotive engineering from Daelim University in Anyang, Gyeonggi Province.

Why can‘t chip manufacturers improve their infrastructure or add more factories to increase production?

Again, it really involves the different characteristics of the memory chip and automotive chip sector.

The two markets are actually incomparable, not only due to composition, but in terms of market size.

According to market evaluator Strategy Analytics, Samsung Electronics sold 272 million smartphones globally in the last year. But the world’s largest automaker Toyota sold some 9 million cars globally last year.

This size difference can also be seen on a wafer scale.

Automotive chips are produced based on a 8-inch wafer, compared to the 12-inch wafer used for smartphone chips. Due to its smaller size, the number of semiconductors put onto a wafer is limited. Why don’t auto chip makers rely on 12-inch wafers then? The chipmakers using 12-inch wafers don’t need to increase their number of facilities for more customers. With the clients they have, companies have already achieved economies of scale in production.

This low-margin structure of the automotive chip market has been a hurdle for manufacturers from expanding their facilities aggressively, because what they need to care about is not expanding, but lowering the price of a tiny chip by 1 cent for cost reduction.

Could new players like Intel or Samsung make automotive chips too meet demands?

Unlike smartphone semiconductors, automotive chips require a higher standard in terms product quality and brand reliability because quality of auto chips are closely connected to driver safety. A minor defect in an auto chip can lead to an uncontrollable accident on the road, which can significantly tarnish the brand’s credibility.

Such fastidious product reliability checks through repeated qualifying tests has shaped the market with a small quantity batch production system, making it so new entrants will have to take years to secure carmaker’s trust and get orders.

While Samsung and Intel dominate the overall semiconductor market and TSMC practically stands alone in the foundry business, and Qualcomm and Nvidia lead the fabless business, the market for automotive semiconductors is a whole different story. It is divided between the Netherlands’ NXP with 21 percent market share, Germany’s Infineon Technologies (19 percent), Japan’s Renesas Electronics (15 percent), US’ Texas Instruments (14 percent) and Switzerland’s STMicroelectronics (13 percent.)

When will I get my car?

According to industry experts, the current automotive chip supply crunch is expected to be relieved in a year, at minimum.

It is almost impossible to have all chips needed for auto parts to be normally supplied as it was pre-pandemic. Chips for core auto parts that carmakers are missing vary, and the number of such chips are as many as 40. Such chips are manufactured based on customized order, through seven different makers.

“The number of chips needed for automotive manufacturing is high, and the types of chips needed also varies per automaker. One or two chipmakers managing to go back to original manufacturing schedule won’t resolve the current issue,” said Park Jung-kyu, a professor of machine engineering at Hanyang University in Seoul.

Data from market tracker IHS Market showed that global automotive production volume will reduce by 672,000 units in the first quarter this year due to chip shortages, while at least 964,000 fewer cars will be produced by the year-end.