Kim Suyi, head of Canada Pension Plan’s Asia-Pacific operations (left) speaks at a forum hosted by Women Corporate Directors Korea to urge financial groups to adopt quotas for female board representation in Seoul in 2018. NH Financial Group Chairman Kim Gwang-soo (second from left), former Korea Federation of Banks President Ha Young-koo (third from left), Korea Corporate Governance Service President Cho Myeong-hyeon (third from right), Yellowdog Managing Partner Je Hyun-joo (second from right) Yellowdog Managing Partner and Korean Women Economists Association Chairperson Lee Eun-hyung (right) also joined the forum as panelists. (Yonhap)

[EMPOWERING WOMEN FINANCIERS]

The Korea Herald is publishing a series of articles to shed light on efforts to transform South Korea’s financial market by having more women financiers both at working and leadership levels and the challenges they face. This is the first installment. -- Ed.

The industry-wide campaign to “break the glass ceiling” has been going on for years, with little progress so far, particularly in South Korea’s financial market which is male-dominated.

Experts say that this has led to a lack of diversity, and innovative, creative ideas needed to transform financial institutions and the market landscape in the face of growing uncertainties.

The ceiling, however, looks even higher and thicker at the top decision-making level of the nation’s five largest financial groups, they pointed out.

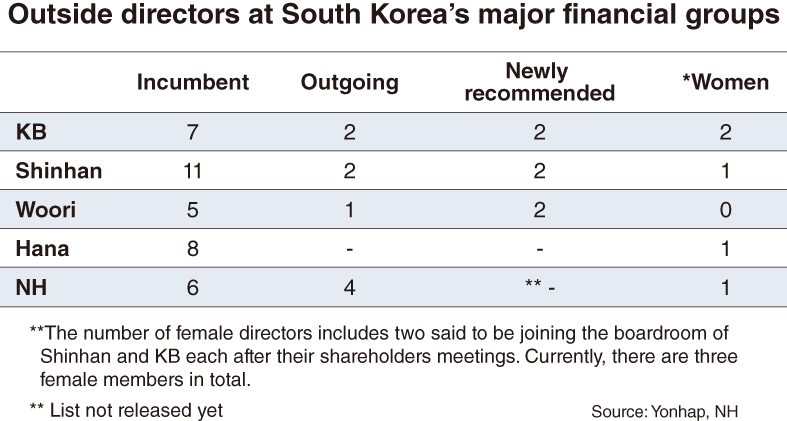

Recent data suggested that the big five -- Shinhan Financial Group, KB Financial Group, Woori Financial Group, Hana Financial Group, and NH Financial Group -- have a combined 37 outside directors. Only three, or 8 percent, are female -- one each from KB, Hana and NH.

Though currently low, local financial giants are moving to have more women representation on boards, within the boundary of a new law.

A newly revised Financial Investment Services and Capital Market Act passed in January, is expected to help pave the way for women to gain more influence in boardrooms, according to market watchers. It stipulates that listed firms with 2 trillion won ($1.7 billion) or more in total assets should not have board comprised of only one gender. Ironically, the rule is mandatory but not subject for any penalty. The purpose of revising the act was to enforce companies to have more than one-third female representation in boardrooms. But the size got smaller, citing the possibility of placing “excessive burden” on companies.

Though the act holds limited power, the change it might entail is widely expected.

“Although Korea is nearly 10 years behind in terms of gender equality at work, compared to nations like Finland, which launched a similar law regarding corporate directors, the latest act can become a milestone for financial firms as well as Korean companies in general,” Lee Bok-sil, chairman of the Korean chapter of Women Corporate Directors, a global foundation, and a former vice minister of gender equality and family here.

“Considering a large pool of talented and skilled female executives working at the forefront in the business world, there will be more chances for women to play crucial roles in boardrooms in the near future,” she added.

The number of companies that will be affected by the revised act, scheduled to be implemented in July with a two-year grace period, stands at 210 as of January, according to the WCD Korean Chapter. Of the total, 165, or 78.5 percent, have currently no woman on corporate boards. Among them are KT, SK Group, LG Group, Hanwha and Industrial Bank of Korea, shortly IBK.

Only 45 companies, including Samsung Electronics, KB Financial Group, Hotel Shilla, and Korean Air have at least one female director.

As part of their own efforts to make boardrooms more gender diverse, some financial firms have started newly recruiting seasoned female financial experts as board directors.

Shinhan Financial Group recently announced it would appoint Yoon Jae-won, a professor at Hongik University as one of the its two new outside directors. When the recommendation is approved at a shareholders meeting on March 26, Yoon, an accounting and tax expert, will be the first woman on the company’s board.

“The new female director will help improve gender diversity in the board while being able to make great contributions in the firm’s decision making process,” an official from the financial firm said.

KB Financial Group, which vies for the top spot with Shinhan, has made a similar move as it has recommended Kwon Seon-joo, a former chief of IBK, as one of the firm’s new outside directors. Kwon, who has a title as the first female bank CEO in Korea under her belt, will be the second female director at the financial conglomerate after Choi Myung-hee, who has been serving for the board from March 2018.

KB’s latest decision came after it named its first female CEO, Park Jeong-rim, at brokerage house KB Securities in December 2018. The sitting co-CEO Park, who leads the stock trader’s wealth management unit, is also the first female chief exec in the brokerage sector.

Expanding female board representation appears to be gaining momentum globally.

An increasing number of governments around the world have been pushing businesses to have more women on corporate boards. In Norway, a board comprised of nine or more members must have 40 percent female representation. If a company fails to abide by the rule, it may face delisting. The proportion of female board members required by local laws in Spain and Germany stands at between 30-40 percent, although the legal details differ. In California, all listed firms need to have at least one female director, or they could face a fine.

“Different from laws in other nations, no penalty will be imposed on domestic companies that do not follow the new capital markets act, but they would miss the chance to become responsible employers if they fail to comply with the law,” Lee said.

By Kim Young-won (

wone0102@heraldcorp.com)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)