SK hynix, the second-largest chipmaker in the world, announced Friday its lowest quarterly operating profit in three years in the second quarter of this year, and has decided to downsize production amid growing concerns about demand recovery and impact of the trade dispute with Japan.

The company said it posted 6.45 trillion won ($5.46 billion) in sales during the April to June period, down 38 percent from a year earlier, while recording 638 billion won in operating profits.

Second-quarter operating profit plunged 89 percent on-year, marking the smallest since 452.9 billion won in the second quarter of 2016.

The operating margin slid to 10 percent, shaving off 44 percentage points from a year before.

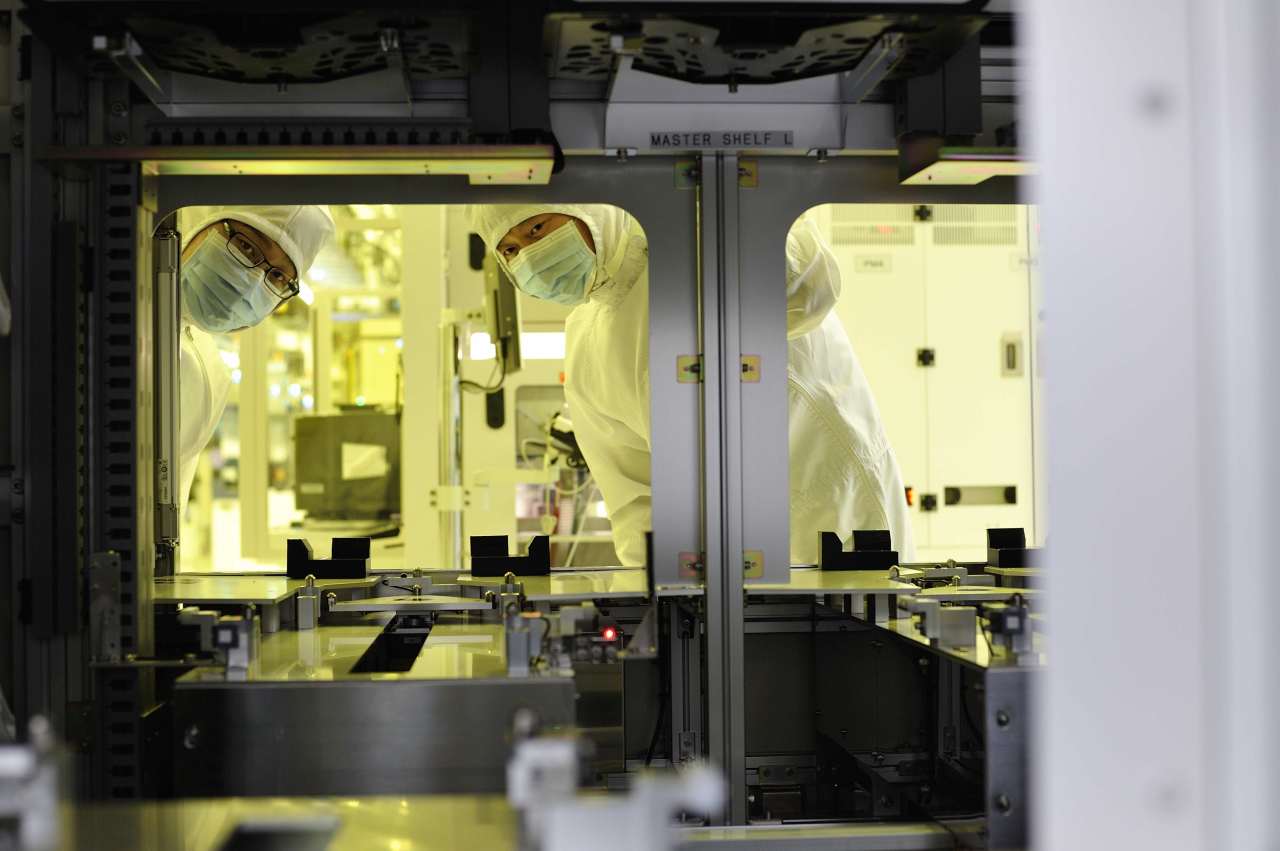

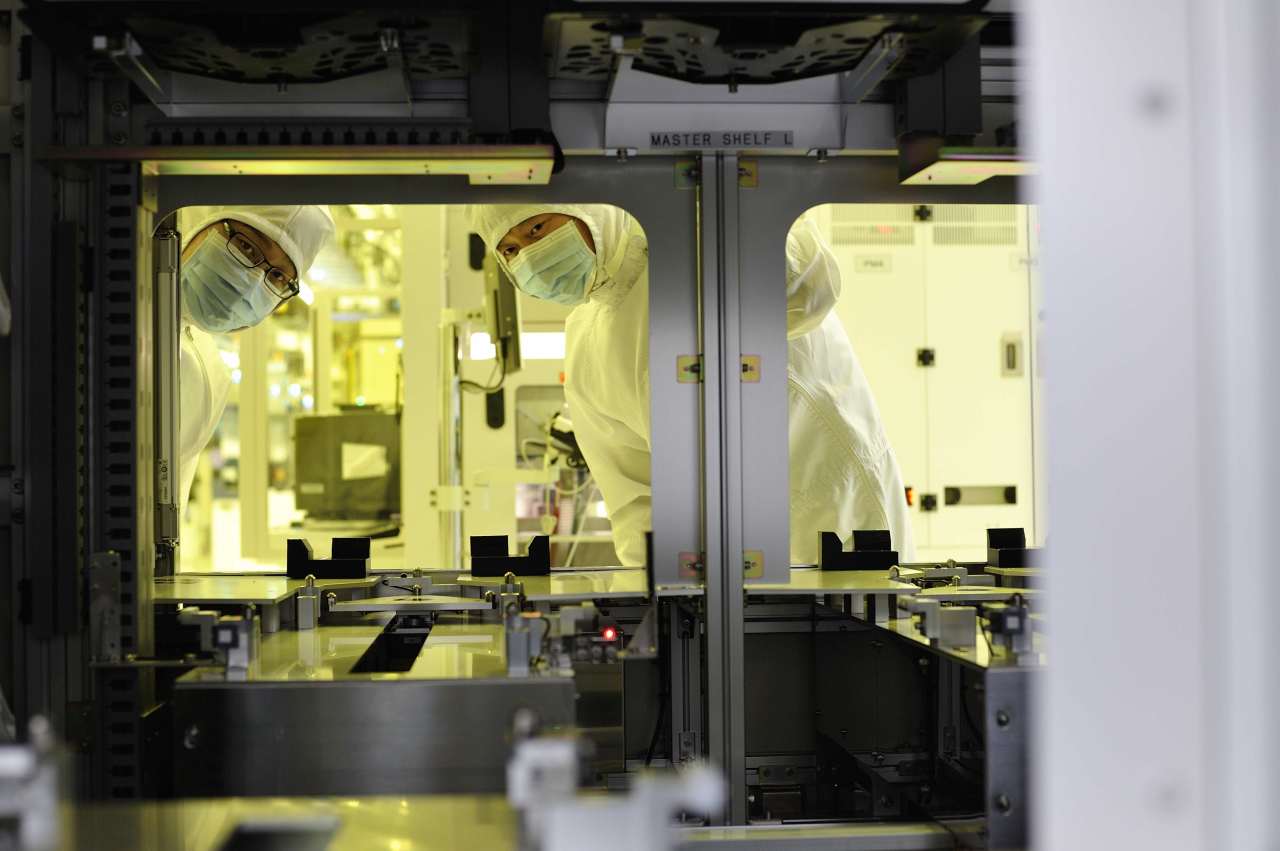

SK hynix engineers in smocks work at its M14 line in Icheon, Gyeonggi Province. (SK hynix)

Memory price falls were the chief reason for the tumbling profit amid a slower-than-expected recovery in demand, the company said.

Despite a 13 percent on-quarter increase in DRAM bit shipments, sales and profit declined due to a 24 percent drop in the average selling price.

NAND Flash’s bit shipments grew 40 percent compared to the previous quarter, but its average selling price fell 25 percent.

Against this backdrop, SK hynix plans to adjust production and investment flexibly to respond to market conditions.

The company said it will cut its DRAM production capacity from the fourth quarter and will convert part of the DRAM production lines of its M10 fab in Icheon, Gyeonggi Province, to CMOS image sensor mass production lines from the second half.

“This is to reduce DRAM wafer capacity considering the DRAM demand environment and to strengthen the competitiveness of its CIS business,” it said

For NAND, the company will expand its planned wafer input reduction from 10 percent to 15 percent.

Under the decision, SK hynix might also change its initial plans to expand the clean room at M15 in Cheongju, North Jeolla Province, and to install equipment at M16 in Icheon.

Amid the intensifying trade dispute between Korea and Japan, SK hynix is aggressively securing the materials essentially needed for the chipmaking processes, including etching gas and photoresists, the company said.

“As the trade dispute gets fiercer, concerns about memory demand are growing, prompting customers to turn even more conservative,” said Cha Jin-seok, executive vice president of SK hynix.

“If the Japan restrictions prolong, we can’t rule out the possibility of having difficulty in production.”

Industry watchers have raised speculations that Samsung Electronics, the world’s top memory provider, could also join the production cut as it is scheduled to announce its second quarter earnings Wednesday.

Samsung had said it would post 56 trillion won in sales and 6.5 trillion won in operating profit in the second quarter in a preliminary guidance.

Despite the poorer performance than expected, Samsung said it provided a total of 32.3 billion won for 19,000 employees of 271 suppliers in incentives for the first six months of the year.

By Song Su-hyun (song@heraldcorp.com)