South Korea’s household debt grew faster than disposable income in 2015, a government report showed Tuesday, amid concerns over record-high household debt.

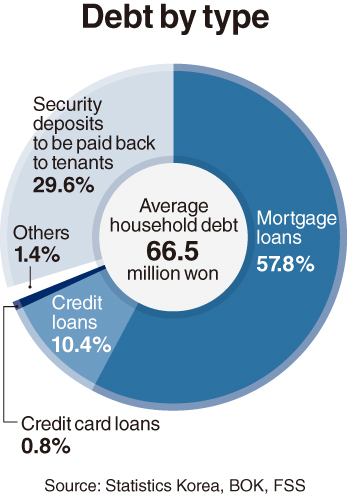

As of March this year, an average Korean household had 361 million won ($303,000) in total assets, 66.5 million won in debt and annual disposable income of 40 million won. All three rose at a moderate pace, but debt grew the fastest, with 6.4 percent yearly gain, and income lowest with 2.4 percent growth.

The key findings came in a report jointly released by Statistics Korea, the Bank of Korea and the Financial Supervisory Service, to glance over a big picture of Korean households’ financial well-being.

(123rf)

Based on a survey of 20,000 households and data collected from the start of 2015 until March this year, the report showed the average household debt rose to 66.5 million won, up 6.4 percent from a year earlier.

The report comes as rising household debt is being cited as a major downside risk by economists. The total household debt is estimated to have exceeded 1,300 trillion won as of October, according to government data.

Out of the total debt, 70 percent constituted borrowings from financial institutions and the remaining 30 percent were down payments that landlords have to return to tenants upon completion of the housing contract. The majority of financial debt was in mortgage loans, which took up about 58 percent of the total debt, the report said.

The combined debt of households with top 20 percent of income earnings accounted for 47 percent of total debt, while that of those at the bottom 20 percent took up 3.9 percent.

By age, people in their 50s were the most heavily indebted with an average of 83.8 million won in debt per person, followed by 40s with 80 million won and 30s, 58.7 million won.

In contrast, the average disposable income only inched up 2.4 percent last year to 40 million won from a year earlier, due to weak growth in wages and business income.

Households’ financial health, gauged by the proportion of financial debt out of the disposable income, has worsened, up 5.5 percentage points to 116.5 percent in 2015, the report said.

“The government will conduct a stress test on financial institutions and individual borrowers to prepare for a rise in market interest rates,” the Finance Ministry said in a separate statement.

“The government will also apply stricter lending rules to group mortgage loans for newly built apartment purchases, and to borrowings from nonfinancial companies.”

By Kim Yoon-mi (yoonmi@heraldcorp.com)

![[Graphic News] Number of coffee franchises in S. Korea rises 13%](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/05/02/20240502050817_0.gif&u=)