[

THE INVESTOR] The National Tax Service is investigating foreign tobacco companies over suspicions that they evaded taxes, industry sources said on Aug. 30.

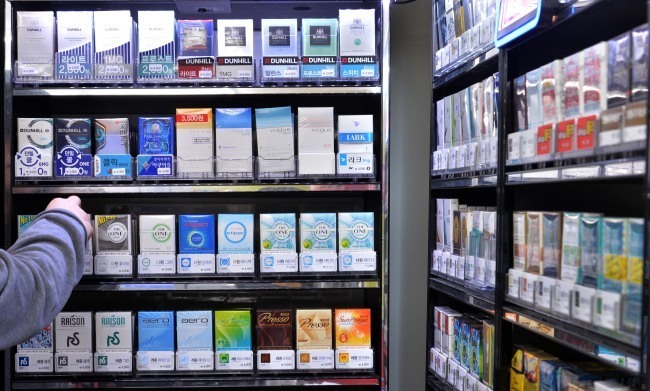

Citing the need to discourage smoking, South Korea marked up taxes levied on cigarettes by 2,000 won (US$1.79) in January last year, raising the price to 4,500 won per pack.

Cigarette makers are said to have raked in tens of millions of dollars in so-called inventory profit by keeping products shipped out before 2015 in stock and selling them after the tax hike for huge gains.

According to the sources, the tax agency has been conducting an extensive tax probe into Philip Morris Korea, which sells the Marlboro brand, and British American Tobacco Korea, the vendor of Dunhill cigarettes.

NTS investigators are focusing on suspicions that some tobacco companies, aware of the expected price hike beforehand, pocketed “excessive” profits by stocking up on products and selling them after the tax increase, they said.

An NTS official refused to confirm the tax probe, citing an office policy that it can’t “comment on a tax audit into a specific taxpayer.”

Faced with a growing public outcry, South Korea’s sole tobacco maker

KT&G announced in April last year that it would donate 330 billion won for social contribution activities. KT&G spent 80.8 billion won last year and plans to fork out 70 billion won this year.

Some watchers said KT&G may have been spared a tax audit because of its donation.

Philip Morris and BAT Korea complain that it is unfair and discriminatory against foreign tobacco companies for the NTS to exclude KT&G, which they argue reaped the largest inventory profit from the tax hike.

(

theinvestor@heraldcorp.com)

![[H.eco Forum] H.eco Forum calls for transition to clean, carbon-free energy](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/05/22/20240522050668_0.jpg&u=20240522175145)

![[Exclusive] LACMA admits it needs further research on donated Korean paintings](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/05/22/20240522050568_0.jpg&u=20240523001632)