This is the first in a series of articles analyzing the top 10 companies by market capitalization traded on the tech-heavy KOSDAQ stock market. ― Ed.

Celltrion’s biosimilar drug Remsima, based on Johnson & Johnson and Merck & Co.’s anti-inflammatory biologic drug Remicade. (Celltrion)

Hot stocks on KOSDAQ, the Korean equivalent of the U.S.’ Nasdaq, often hold hints of where the future lies for Korea Inc.

Back in 1996, when the bourse first opened as the market for innovative tech firms, the company that boasted the biggest market capitalization there was shipbuilder Hyundai Heavy Industries. Near the end of the ’90s IT bubble, the crown went to Korea Telecom Freetel, now KTF, and in mid-2000s with the rise of Internet firms, NHN took over.

After shipbuilding, telecom and Internet, now is the era of pharmaceuticals.

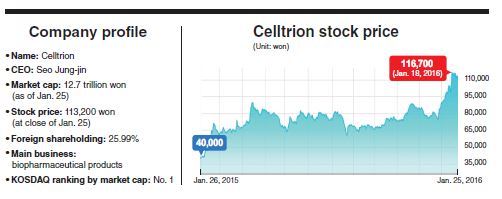

Celltrion, an Incheon-based maker of biosimilar drugs, is the overwhelming No. 1 on the list of top 10 KOSDAQ-listed companies by market cap. Its market value, based on Monday’s closing price of 113,200 won ($110) per share, exceeds 12.7 trillion won. (Most of earlier KOSDAQ heavyweights including HHI, KTF and NHN, are not on the list, as they have long migrated to the main stock market KOSPI.)

Fast-sprawling mobile giant Kakao is a distant runner-up with 6 trillion won in market cap. Conglomerate CJ Group’s entertainment unit CJ E&M comes third with 3.4 trillion won.

“Celltrion shares advanced sharply recently in anticipation of an imminent U.S. market breakthrough for its biosimilar drug Remsima,” said Choi Dong-hwan, an analyst at Seoul-based brokerage house Shinhan Investment.

Shares in Celltrion nearly tripled in the past year, moving from 40,000 won on Jan. 26, 2015, to a peak of 116,700 won on Jan. 18 this year, settling at 113,200 won on Monday. The record-breaking rally pushed its market cap past 13 trillion won, although profit-taking pulled its stock price and market cap down to the current levels.

The stock’s stellar performance has put the KOSDAQ-traded Celltrion on par with bigger and far better known companies on KOSPI, such as SK Innovation, SK Group’s energy business unit and LG Corp., the holding firm of electronic giant LG Electronics. The two firms, valued at around 12 trillion won, rank 20th and 21st on KOSPI in terms of market cap.

The rise of Celltrion is in line with a broader market trend that made the KOSPI-traded Hanmi Pharmaceutical a darling of investors. Hanmi Pharmaceutical and its parent firm Hanmi Science were top earners on KOSPI last year, with Hanmi Science recording a whopping 800 percent gain, thanks to two multitrillion-won deals clenched by the drug maker.

For Celltrion, the prospect of a U.S. market breakthrough for its flagship product has been driving the gains in its stock prices.

The U.S. Food and Drug Administration is scheduled to convene a committee meeting early next month to review and discuss approving Remsima, a biosimilar replication of the world’s third best-selling rheumatoid arthritis treatment drug Remicade. Biosimilars refer to lower-cost copies of brand-name biologic drugs that have lost patent protection.

“Given that Remsima has won approval in 67 countries including Europe, a U.S. approval seems highly likely,” said NH Investment & Securities analyst Lee Seung-ho.

The U.S. accounts for roughly 54.5 percent of Remicade’s global market valued at roughly 10 trillion won. If approved, Remsima ― up to 40 percent cheaper than the original Remicade ― is forecast to steal a significant portion of the original’s sales in the country.

Koo Wan-sung from HI Investment & Securities said: “Celltrion is likely to exclusively lead the U.S. Remicade biosimilar market for two years through its marketing partner Pfizer.”

The company is also developing biosimilar replications of Genentech’s Rituxan, used to treat lymphatic cancer, and Roche’s blockbuster breast cancer treatment Herceptin.

Reflecting the rosy business outlook, several local securities firms have raised their target prices for Celltrion stock to as high as 150,000 won per share.

Celltrion CEO Seo Jung-jin said last year that he will push to list Celltrion Healthcare, the company’s unlisted drug-selling affiliate, on KOSDAQ in 2016 and plans to integrate it into Celltrion.

By Lee Sun-young (

milaya@heraldcorp.com)