South Korean conglomerates are on high alert as the National Pension Service, the nation’s largest investor, is forecast to actively exercise its voting rights at their annual shareholders’ meeting this month.

“We are expanding our analysis of corporate proposals this year with the help of outside advisory firms for the first time,’’ an NPS official said on condition of anonymity.

The Korea Corporate Governance Service and Sustinvest are offering advisory services to the NPS for voting on proposals to be submitted at the 2015 shareholders’ meetings of companies that the state-run pension fund has invested in.

With its growing influence in the domestic capital market, the NPS has been pressed to actively exercise its shareholder voting rights on management issues.

According to CEO Score, an online corporate information provider, the NPS has a stake higher than 5 percent in 107 conglomerates listed on the main stock bourse, as of Jan. 16.

In 64 of these companies, the NPS has a higher stake than the owner family members.

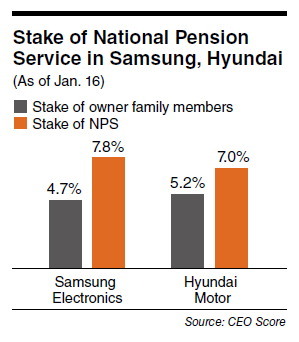

CEO Score also found the NPS to be the largest shareholder in Samsung Electronics with a 7.8 percent stake. Samsung Group chief Lee Kun-hee and his family members hold a 4.7 percent stake in the electronics firm.

The same trend was found in the governance of Hyundai Motor, the nation’s second-largest conglomerate. The NPS’ stake in the automaker stands at 7 percent, compared to the combined 5.2 percent owned by group chairman Chung Mong-koo and his family members.

“Considering the reality that many local institutional investors are influenced by the conglomerates, the NPS has to take on the role of an inspector,’’ a KCGS official said.

Civic groups have asked the NPS to act on malpractices of major firms in the country, including appointments of corrupt owners or incompetent executives as standing board members.

As a case in point, the NPS voted against the reappointment of auto parts-maker Mando Corp. CEO Shin Sa-hyeon at the firm’s annual shareholders’ meeting last March.

As the second-biggest shareholder in Mando, the NPS asked Shin to be responsible for the fall in stock prices after Mando bought a stake in construction affiliate Halla Corp. via a third party.

The nation’s big business circles, however, have raised concerns over the negative impact of the NPS’ involvement in exercising its shareholder rights.

“Shareholder activism of the national pension fund could be seen as government intervention in corporate management,’’ said an official from the Federation of Korean Industries, a big business lobbying group.

“In addition, the NPS’ intervention could put companies in jeopardy when it is obsessed with short-term gains from its investments like other speculative investors.’’

Despite such concerns in the corporate sector, industry watchers said the NPS will play a role in improving the governance of family-controlled Korean conglomerates.

The NPS has grown as the world’s third-largest pension fund with assets of 469.25 trillion won ($422.32 billion) under management last year, which is equivalent to about 33 percent of Korea’s gross domestic product. In its investment portfolio, it allocates 80 percent of the funds to the domestic market, while investing the rest in in overseas markets.

By Seo Jee-yeon (

jyseo@heraldcorp.com)

![[Grace Kao] Hybe vs. Ador: Inspiration, imitation and plagiarism](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/28/20240428050220_0.jpg&u=)

![[Herald Interview] Mom’s Touch seeks to replicate success in Japan](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/29/20240429050568_0.jpg&u=)