Last month, Alibaba Group Holding Ltd.’s Jack Ma invited 1,600 former employees to its home turf in Hangzhou, China. The company’s $25 billion initial public offering had made many of them wealthy and he urged them to start businesses that would be meaningful in the long term.

“He knew a lot of us got rich and wanted to tell us not to waste our money,” said Sun Shuihua, who worked at Alibaba for a decade. “He told us to treat our wealth responsibly.”

Sun, 36, has already started: She’s spending 5 million yuan ($804,000) to found an online retail business, becoming part of a generation of Alibaba workers who have made their fortunes and are now putting the money into start-ups.

China is beginning to emerge as a legitimate contender to Silicon Valley as the center of the technology industry, fueled by an Alibaba IPO that brought in more money than any in history. Chinese technology companies have raised $30.3 billion in IPOs this year, compared with $4.97 billion for their U.S.- based peers, according to data compiled by Bloomberg.

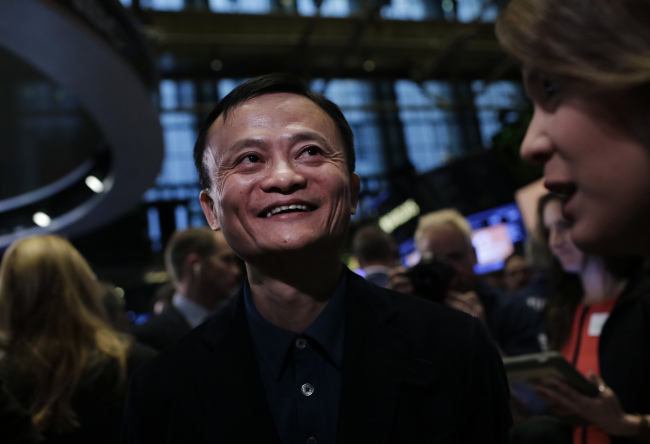

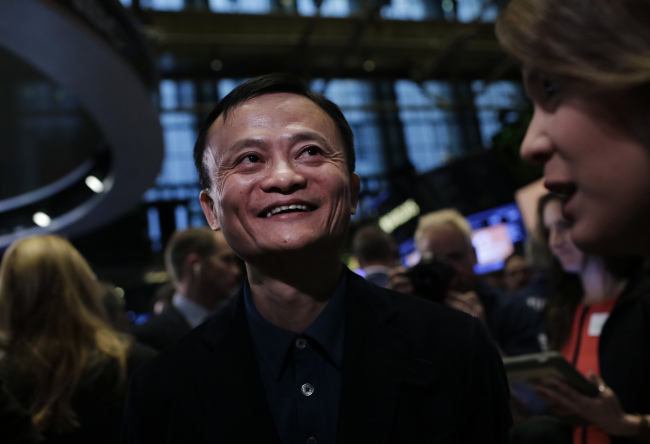

Alibaba CEO Jack Ma. (Bloomberg)

“Today in Hangzhou, you could be having dinner at a night market and you’ll hear people around you talking about their startups,” said Wang Huadong, a Beijing-based partner at Matrix Partners China, which manages $1.2 billion of assets. “You’re seeing a wave of people trying to set up their own businesses, trying to find the next big opportunity.”

Chinese start-ups benefit from the country’s position as the world’s largest Internet market, with 632 million users. Venture investments in Chinese companies climbed to $8.1 billion in the first three quarters, more than double the $3.5 billion for all of last year, according to Ernst & Young LLP. China trails only the U.S., where venture investments were $37.3 billion this year.

Hangzhou, a city of 8 million, is emerging as the latest technology hub in China due to the wealth created from Alibaba, adding to those in Beijing, Shanghai and Shenzhen. Alibaba shares have surged more than 60 percent since its IPO, giving the company a greater market valuation than General Electric Co.

Jenny Lee, a Shanghai-based partner at GGV Capital, said Hangzhou accounts for a third of about 20 investments the firm has made in China this year, compared with none a year ago. GGV manages $2.2 billion of funds and invested in Alibaba before the IPO. The start-ups are mainly focused on e-commerce, location-based services and Internet finance, areas where Alibaba employees hold expertise, Lee said.

Cofounded by Ma in 1999, Alibaba gives many employees company shares, usually in the form of stock options or restricted shares, which they can hold onto after they quit. Rachel Chan, a company spokeswoman, declined to say how many employees have shares worth more than $1 million.

Qiu Jinliang, 33, another former employee who says his shares are now worth about $1 million, left Alibaba in August to start an online furniture shop.

“I felt bigger opportunities awaited for me outside,” said Qiu, who spent nine years at Alibaba. With the burgeoning local start-up scene, “the timing for starting a business is great,” he said.

Even before the IPO, Alibaba’s shares were being bought and sold by employees on an internal site called Aliway.com. Sun, who stocked up on shares, says she doesn’t need to seek venture capital for her business, which will sell baby health and safety products. She said she isn’t planning to sell her shares for another three years.

“This is going to attract a lot of hatred and envy when I say it, but we really don’t lack money,” said Sun. “We won our first bucket of gold, and now what we want to do is something grand and meaningful.” (Bloomberg)

![[Weekender] How DDP emerged as an icon of Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/25/20240425050915_0.jpg&u=)