The Bank of Korea and the Ministry of Strategy and Finance seem to be at odds over the country’s growth prospects, raising the possibility of another round of debate over the key base rate.

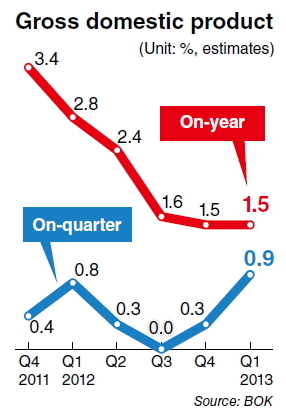

The central bank announced Thursday better-than-expected gross domestic product growth of 0.9 percent in the first quarter owing to improved exports and revived facility investment.

But the government still says it is time for monetary policy to kick in and work alongside fiscal policy so the economy can break out of the low-growth trap of below 1 percent for eight straight quarters.

The Bank of Korea forecast an economic recovery toward the latter half of this year on the back of increasing global demand led by the U.S. justifying its key rate freeze this month.

The first-quarter 0.9 percent growth is above the initial projections of 0.8 percent by the central bank and 0.5 percent by the Finance Ministry. The growth is the highest since the first quarter of 2011 when the country’s GDP growth was 1.3 percent.

The Finance Ministry, however, has a gloomy outlook given the current economic conditions, and Deputy Prime Minister and Finance Minister Hyun Oh-seok said the time was ripe for its fiscal stimulus measures, including its supplementary budget, to be put into action soon.

Otherwise, Korea’s economic growth represented by “the Miracle of Han River” would become a “Stalled Miracle,” he said, adding that Korea needs to seek new growth in emerging markets in addition to Brazil, Russia, India and China, or the so-called BRIC economies.

Hyun, unlike some other government officials who called for a lower interest rate, has never officially made statements regarding the central bank’s monetary policy as is common for finance ministers or treasurers in other countries. He did say, however, that a policy mix needs to be in place to boost growth.

BOK Gov. Kim Choong-soo remained adamant in defense of the central bank’s rate decision. He told lawmakers at a National Assembly briefing that he has never sent any vague messages, and that it was the market that interpreted it the wrong way.

Kim emphasized the central bank’s independence, and that it has already made use of its monetary policy to help the market by lowering its benchmark rate twice last year. He added monetary policy decisions are made based on economic forecasts of six months to a year, and it would not be effective for Korea to follow the current monetary easing path of advanced economies such as the U.S. and Japan as it could increase capital-flow volatility.

The governor also recently mentioned that it would be more important to implement a sound credit policy over monetary policy to boost funding for small and medium enterprises. He reiterated the central bank’s position against a key rate decrease as the country’s fiscal stimulus is enough to improve the economy.

The general market is still seemingly divided over the key rate ― some analysts say the central bank may move to increase its rate as government spending would likely put upward pressure on consumer prices, while others argue that it still has room for a rate cut to stimulate growth, while inflation remains low.

“The government’s new fiscal stimulus, which will likely equal about 1 percent of GDP, and measures to lift the housing market relieve pressure on the BOK to lower rates … suggesting a long period of steady rates ahead,” Moody’s Analytics said.

IM Investment & Securities suggested that the central bank could cut its benchmark rate at least once in the year’s remaining fiscal quarters as pressure exists from a weak growth and a weak yen to the dollar.

By Park Hyong-ki (hkp@heraldcorp.com)

![[Weekender] Korean psyche untangled: Musok](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/05/02/20240502050841_0.jpg&u=)

![[Eye Interview] 'If you live to 100, you might as well be happy,' says 88-year-old bestselling essayist](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/05/03/20240503050674_0.jpg&u=)