Toyota Motor Corp.’s recovery is proving tougher than anticipated.

Already poised to lose its crown as the world’s largest carmaker this year, Toyota yesterday cut its profit forecast by more than half after Thailand’s worst floods in almost 70 years disrupted output of Camry and Prius vehicles. While the rebound at rival Nissan Motor Co. accelerates, Asia’s largest automaker has lost four times more production in the floods.

“It’s acts of God after other acts of God,” Jody Lurie, an analyst at Janney Montgomery Scott LLC in Philadelphia, said in a phone interview. “If the U.S. automakers are doing some kind of voodoo to get Toyota out of the top spot, it’s definitely worked.”

Thailand’s floods exacerbated Toyota City, Japan-based Toyota’s struggles after Japan’s earthquake and tsunami in March and the surging yen. The reduced forecasts follow Ford Motor Co. on Dec. 8 declaring its first quarterly dividend since 2006 and precede the likely concession of its three-year reign as the world’s biggest carmaker to General Motors Co.

Component shortages caused by Thailand’s floods disrupted production for Japanese automakers worldwide, compounding the challenge from the record quake and the yen’s surge. Toyota said the Thai floods will cut earnings by 120 billion yen ($1.55 billion).

Net income will fall 56 percent to 180 billion yen in the 12 months ending March 31, the carmaker said in a statement. That’s less than half the profit projected by the average of 21 analyst estimates compiled by Bloomberg.

“It looks like Toyota’s recovery is going to be tougher and take longer than expected,” Satoru Takada, a Tokyo-based auto analyst at TIW Inc., said. “With the strong yen weighing heavily, it’s looking increasingly difficult for Toyota to make its comeback.”

GM has taken advantage of Toyota’s disruptions, gaining market share in the U.S. with the Chevrolet Cruze compact and in China with Buick Excelle sedans. The Detroit-based automaker boosted global sales 9.2 percent to 6.79 million through the year’s first three quarters.

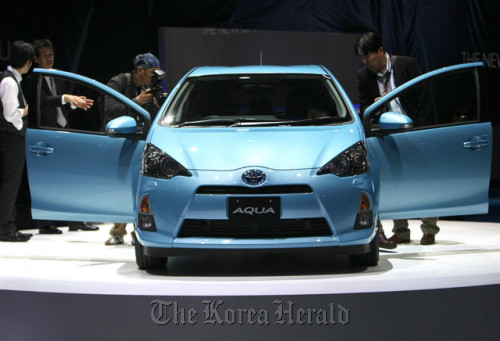

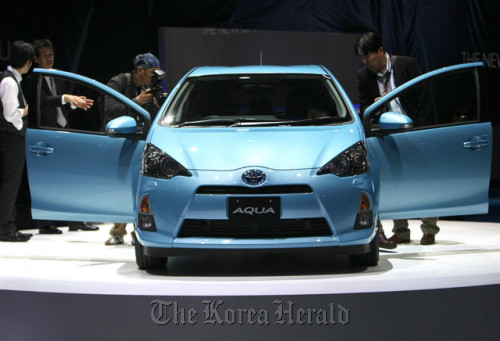

Visitors look at a Toyota Motor Corp. Aqua hybrid vehicle at the Tokyo Motor Show 2011 in Tokyo. Toyota delayed the new projections by a month because of the floods. (Bloomberg)

Toyota fell 0.4 percent in Tokyo trading before the company released its forecasts. The stock has fallen 18 percent this year, underperforming Japan’s benchmark Nikkei 225 Stock Average. The company’s American depositary receipts gained 1.6 percent to $68.20 at the close in New York.

In Thailand, the floods created a second wave of factory disruptions for Japanese carmakers such as Toyota, which had taken six months to restore production hobbled by Japan’s March 11 natural disaster.

Disruptions from the Thai floods will probably cause 260,000 vehicles in lost production, or 3.4 percent of the previous annual target, according to Toyota. By comparison, Nissan estimates lost production of 60,000 units, or 1.3 percent of its annual target.

Toyota probably lost more output than any other carmaker because of the floods, said Masatoshi Nishimoto, a Tokyo-based senior manager at research firm IHS Automotive. Toyota may not be able to make up for lost production of models such as the Vigo SUV until September because the company had procured about 90 percent of the vehicle’s parts from Thailand and won’t easily find alternate suppliers, Nishimoto said.

Toyota revised its outlook for the yen against the dollar to 78 from 80, and 109 from 116 versus the euro, meaning the company expects the stronger domestic currency to reduce operating income by 160 billion yen, it said. The yen, the best- performing major currency this year, forced the company to raise prices, Toyota said.

“We raised prices of some our models on the high yen, and this is very difficult for us to admit, but we expect a drop in sales from this,” Satoshi Ozawa, chief financial officer at Toyota, said at a press conference in Tokyo. “Still, the yen is too strong, and we had to sacrifice some unit sales.”

Toyota delayed the new projections by a month because of the floods. Honda Motor Co., which also pushed back its forecasts because of Thailand, aims to disclose them by the end of January, Chief Financial Officer Fumihiko Ike said last week.

By contrast, Nissan, Japan’s second-largest carmaker, last month raised its profit forecast after its vehicle sales in China rose and the company recovered faster than Toyota and Honda from the earthquake.

Toyota cut its forecast for operating income 56 percent to 200 billion yen, less than half the average analyst estimate compiled by Bloomberg. That means the company will probably earn less profit than Nissan for the third time in four years.

GM and South Korea’s Hyundai Motor Co. (005380) have benefited as their Japanese rivals struggled. GM’s vehicle sales are poised to overtake Toyota’s this year and analysts estimate Hyundai will earn 7.07 trillion won ($6.2 billion) in profit during 2011, more than double Toyota’s.

President Akio Toyoda is aiming to regain lost market share. At the Tokyo Motor Show last week, the grandson of the founder showed off the company’s new 86 coupe, betting the car will widen Toyota’s appeal.

The automaker also displayed a plug-in version of its best- selling Prius hybrid that will go on sale from January. The Prius PHV will become a “winner” that will take sales from GM’s Chevrolet Volt, according to CLSA Asia-Pacific Markets analyst Chris Richter.

A recovery may already be under way in the U.S. Toyota’s November vehicle sales in the country rose for the first time in seven months as supply at dealers recovered and consumer confidence surged the most in more than eight years. The company plans to hire workers in Japan next quarter to increase production in the country, Toyota’s Ozawa said.

(Bloomberg)