The government plans to lower capital gains taxes on home transactions for multiple homeowners and ease regulations on apartment redevelopment in affluent southern Seoul as it strives to prevent a sluggish real estate market from dragging down the economy.

Officials on Wednesday rolled out a package of measures to rejuvenate housing transactions which also include more support for cash-strapped construction firms and low-income earners.

The government will submit related bills to the National Assembly soon aiming to implement the measures next year. Parliamentary and presidential elections are slated for April and December.

Under the plan, the government will delist three upscale districts in southern Seoul as overheated speculation zones, a designation adopted in 2002 to combat speculative investors. The removal is meant to ease a slew of regulations related to apartment redevelopment projects.

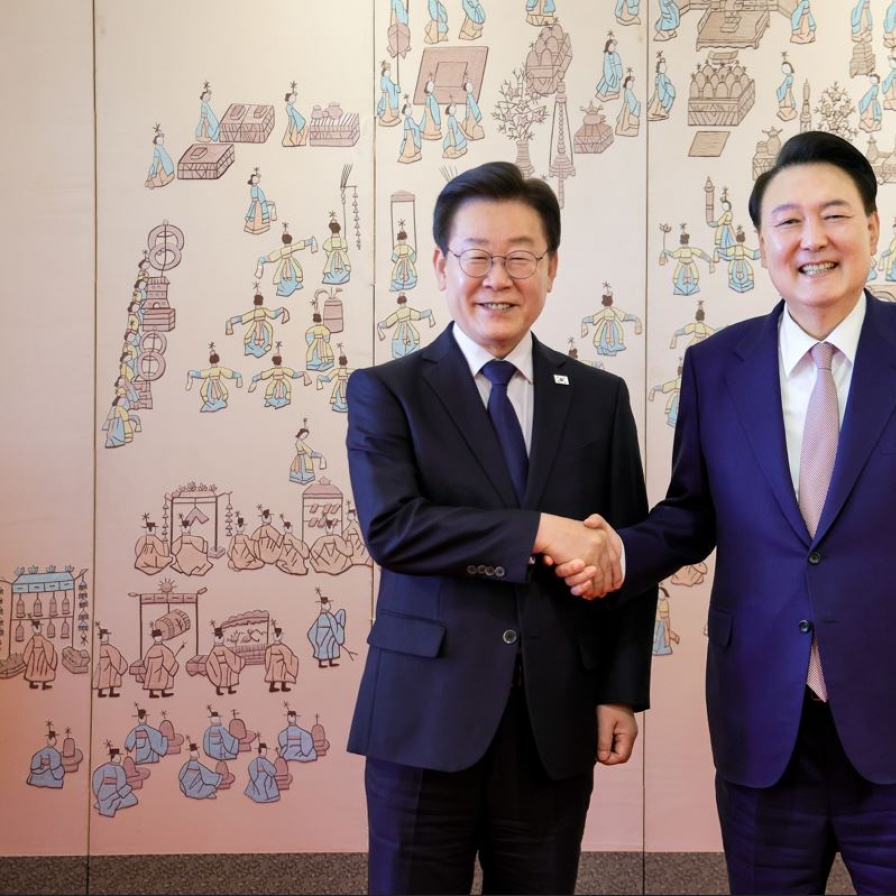

(Yonhap News)

But the areas will still be categorized as speculation zones, thus subject to mortgage loan limits and higher transaction taxes.

The package also calls for abolishing punitive 50-60 percent tax rates levied on capital gains of multiple home owners from selling their property.

The higher rates ― 50 percent for owners of two homes and 60 percent for those with three or more ― were introduced in 2005 to help lower prices. The rates for single-home owners range from 6 to 35 percent. In 2009, the special rates were temporarily suspended until the end of next year.

Mortgage rates will fall to 4.2 percent from 4.7 percent for first-home buyers with an annual income of less than 50 million won ($44,400).

The government also plans to provide loan guarantees for feasible construction projects.

“We’re hoping that the package will normalize the market by scrapping excessive regulations and underpin the livelihoods of low-income households,” Land Minister Kwon Do-youp told reporters.

The protracted downturn in the local property market has been a thorn in the side of President Lee Myung-bak and the ruling Grand National Party ahead of a key election year.

The latest set of measures is also aimed at curbing skyrocketing home rental prices.

In Seoul, “jeonse,” a Korean rent system under which tenants pay lump-sum cash for a certain term, have shot up since 2009, topping 50 percent of house prices in some areas. Such types of residences are common among mid- and lower-income brackets.

In contrast, home prices in the capital city rose a meager 0.7 percent on average so far this year from a year ago.

By region, Gangnam has for years seen speculative capital inflows as the region offers a convenient environment with many private institutions for students.

However, low interest rates in the aftermath of the 2008 financial crisis, coupled with asymmetry between supply and demand, have dampened the construction sector and triggered a string of bankruptcies among mid-sized builders recently.

“Despite some improving indicators, the real estate slump persists chiefly in the Seoul metro area,” Kwon said. “The package could help preemptively stabilize the market ahead of the spring moving season by boosting supplies of affordable housing.”

Some experts still remain pessimistic.

“The package will help keep home prices from falling further but have limited impact on attracting new buyers because they’ve already lost confidence in the market,” said Park Sang-eon, president of U&R, a local real estate consulting firm.

“Given its ongoing push to stave off increasing household debts, the government needs to find other ways to drive up demand.”

By Shin Hyon-hee

(

heeshin@heraldcorp.com)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)