Global investment banks forecast Korea’s consumer prices to increase more than 4 percent this year, citing sustained economic growth and high oil prices, data showed Wednesday.

The average of inflation projections made in May by nine foreign investment banks, including Barclays Capital, rose to 4.1 percent from the 3.9 percent predicted in the previous month, according to the data provided by the Korea Center for International Finance.

Barclays Capital expected the country’s inflation to reach 4.6 percent for this year, the highest among the foreign investment banks. Bank of America Merrill Lynch put its projection at 4.4 percent, and Goldman Sachs’ forecast stood at 4.2 percent. But two investment banks, Morgan Stanley and UBS, forecast the country’s inflation to remain below 4 percent this year.

The investment banks’ inflation forecast is higher than the 3.9 percent estimated by the country’s central bank, the Bank of Korea.

On May 22, the Korea Development Institute, a state-run think tank, raised its 2011 inflation outlook for Korea to 4.1 percent from its previous 3.2 percent estimate, calling for the BOK to actively lift its key rate.

Korea is facing high inflationary pressure due mainly to continued economic growth and rising oil and food prices.

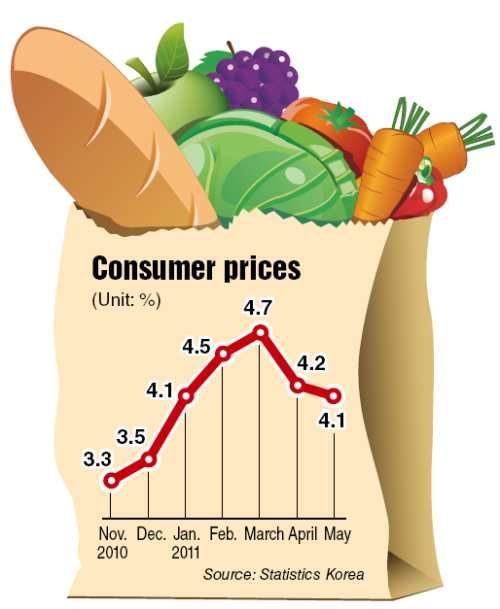

The country’s consumer prices rose 4.1 percent in May from a year earlier, slightly slowing from 4.2 percent on-year expansion seen in April. But the inflation surpassed the upper ceiling of the BOK’s 2-4 percent inflation target for the fifth straight month in May.

Despite inflation risks, the BOK may freeze the key rate at 3 percent in June as economic uncertainty, including the eurozone debt crisis, lingers. The central bank left the borrowing costs unchanged for the second straight month in May after raising them from a record low of 2 percent since July last year.

(Yonhap News)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)