U.S. Federal Reserve policy makers should review whether to complete a second round of quantitative-easing purchasing due to end in June because of strong U.S. economic data, Federal Reserve Bank of St. Louis President James Bullard said.

“The economy is looking pretty good,” Bullard told reporters in Marseille, France, Saturday. “It is still reasonable to review QE2 in the coming meetings, especially this April meeting, and see if we want to decide to finish the program or to stop a little bit short.”

While the economy is clearly stronger than last summer and fall and QE should be reviewed, uncertainties remain, including Japan, Middle East political tensions, the U.S. fiscal position and the European sovereign debt crisis, Bullard said. U.S. first-quarter gross domestic product may not be as strong as anticipated several weeks ago, and some strengthening may get pushed into the second quarter, he said.

The U.S. economy grew at a 3.1 percent annual rate in the fourth quarter, led by a jump in consumer spending that will be hard to match early in the year as energy prices surge. Surging oil prices sparked by turmoil in the Middle East may erode consumers’ purchasing power, and supply constraints caused by the Japan earthquake and its aftermath slow the pace of recovery this quarter.

“The oil price increases so far is not enough to derail the U.S. recovery at this level,” Bullard said. “If oil prices stabilize where they are, we’ll be fine.” Prices would have to go substantially higher for there to be a “significant and material effect,” he said.

“We have to weigh those in the decision” on whether to stop the Fed’s QE2 program earlier than planned, Bullard said.

U.S. central bankers have said they will keep interest rates near zero for an extended period. In contrast, European Central Bank officials indicated this month that uncertainty caused by Japan’s earthquake may not deter them from raising interest rates next month.

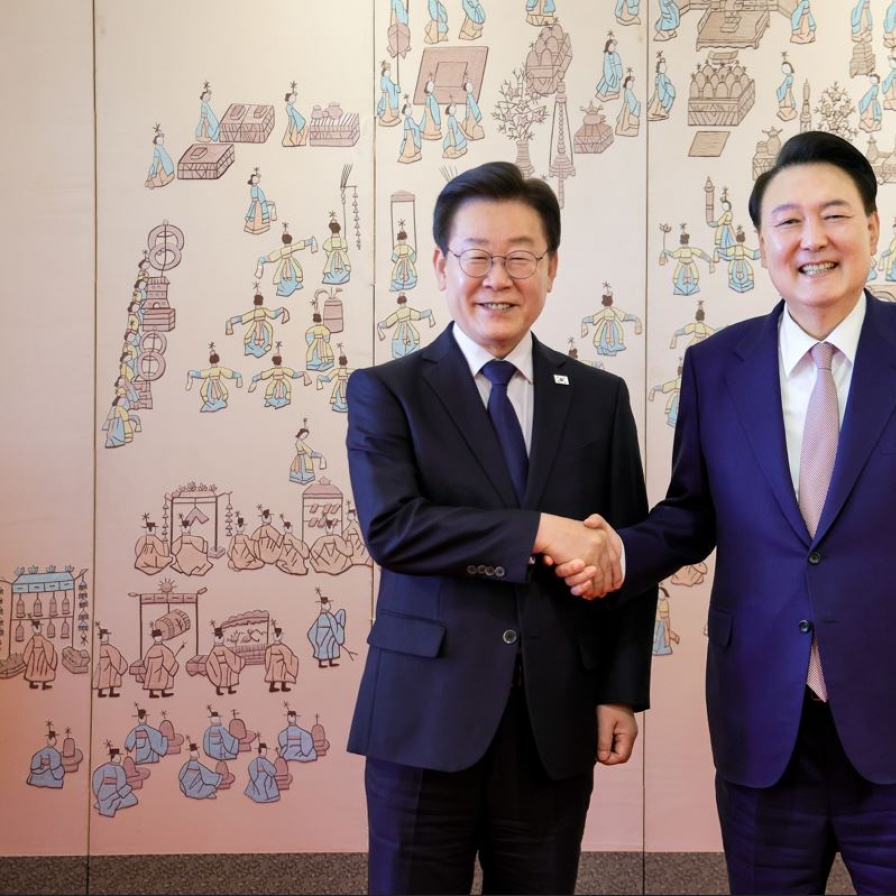

Federal Reserve Bank of St. Louis President James Bullard. (Bloomberg)

“We’re far away from normal policy,” Bullard said. “I think it’s important to take a few steps back to normality. Even if you make a few small moves, monetary policy will still be accommodative for some time to come.”

While the economy may still suffer shocks, the “balance sheet should be contingent” and the Fed should be ready if the economy turns down, he said.

“If the economy is as strong as I think it is then I think it may be reasonable to send a signal to markets that we’re going to start withdrawing our stimulus, and I’d start by pulling up a little bit short on the QE2 program,” Bullard said. “We can’t be as accommodative as we are today for too long, we’ll create a lot of inflation if we do that.”

If the Fed opts to start withdrawing stimulus and tighten policy, it should start with the “balance sheet” by selling bonds first, then changing its wording about keeping interest rates near zero for an “extended period” and then raising interest rates, Bullard said.

Bullard has warned since last July about a risk of Japanese-style deflation in the U.S. while calling for purchases of Treasury securities to reduce the threat. Bullard, 50, voted in favor of the Treasury purchase program in November and has rotated this year into an annual non-voting position.

Bullard said last month the U.S. central bank may need to reduce the amount of purchases in light of stronger U.S. economic data. Philadelphia Fed President Charles Plosser and Richmond Fed President Jeffrey Lacker have also urged a review of the purchases in light of a strengthening economy and concern over future inflation.

“It looks like inflation is bottoming out and if we continue that, I think we will have gone past” the worst, he said. “We seem to be turning the corner there, but I would want to see more data on that.”

(Bloomberg)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)