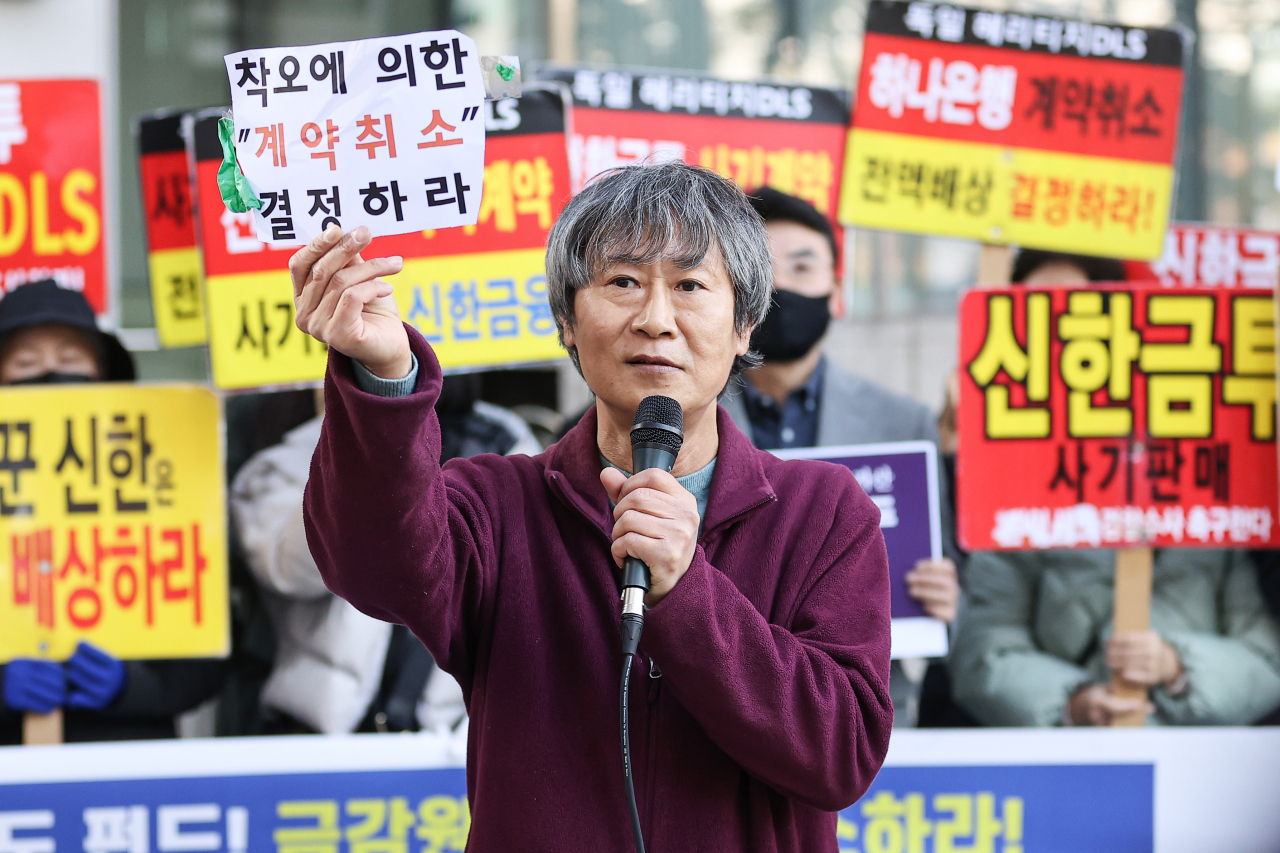

South Korea's financial regulator said Tuesday it will recommend six financial firms to rescind sales contracts on a German fund and reimburse customers, as they provided false information and caused them to make a "mistaken" investment decision.

A dispute-arbitration meeting was held Monday to look into complaints with regard to the German Heritage derivative-linked securities and made the decision, according to the Financial Supervisory Service.

The fund was designed to make a profit from buying and remodeling old buildings in Germany with cultural value.

Six financial firms -- Shinhan Securities, NH Investment & Securities, Hyundai Motor Securities, Hana Bank and Woori Bank –- sold the fund product from April 2017 to December 2018 and pooled over 488.5 billion won ($358.9 million).

The fund redemption, however, has been suspended since June 2019, as a related real estate developer went bankrupt.

The FSS accused those firms of providing false or exaggerated information about the business experience, trustworthiness, and overall financial conditions of the developer, and causing customers to make a "mistaken" investment decision on the high-risk fund.

The regulator expects around 430 billion won to be reimbursed to customers should the arbitration process be completed without a hitch.

The remainder was excluded from the reimbursement recommendation since it is the money of professional investors who must have known the fund's underlying risks, an FSS official said. (Yonhap)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)