MetLife Asia Senior Vice President and Chief Marketing Officer Sanjeev Kapur (MetLife Asia)

South Korea has become an aging society since 2000 and is now on track to become a super-aged society within five years when older people makes up 20 percent of its 50 million population.

With the insurers‘ customers across Asia now expecting longer life spans, helping them build a healthier lifestyle has become a key goal for the businesses, says MetLife Asia’s chief marketing officer.

“MetLife‘s response to the issue of an aging society was the 360Health solution, which helps our customers prevent, diagnose and manage five serious illnesses – such as cancer-- that are the biggest contributors to the gap between the health span and life span of people,” MetLife Asia Senior Vice President and Chief Marketing Officer Sanjeev Kapur told The Korea Herald in a recent interview.

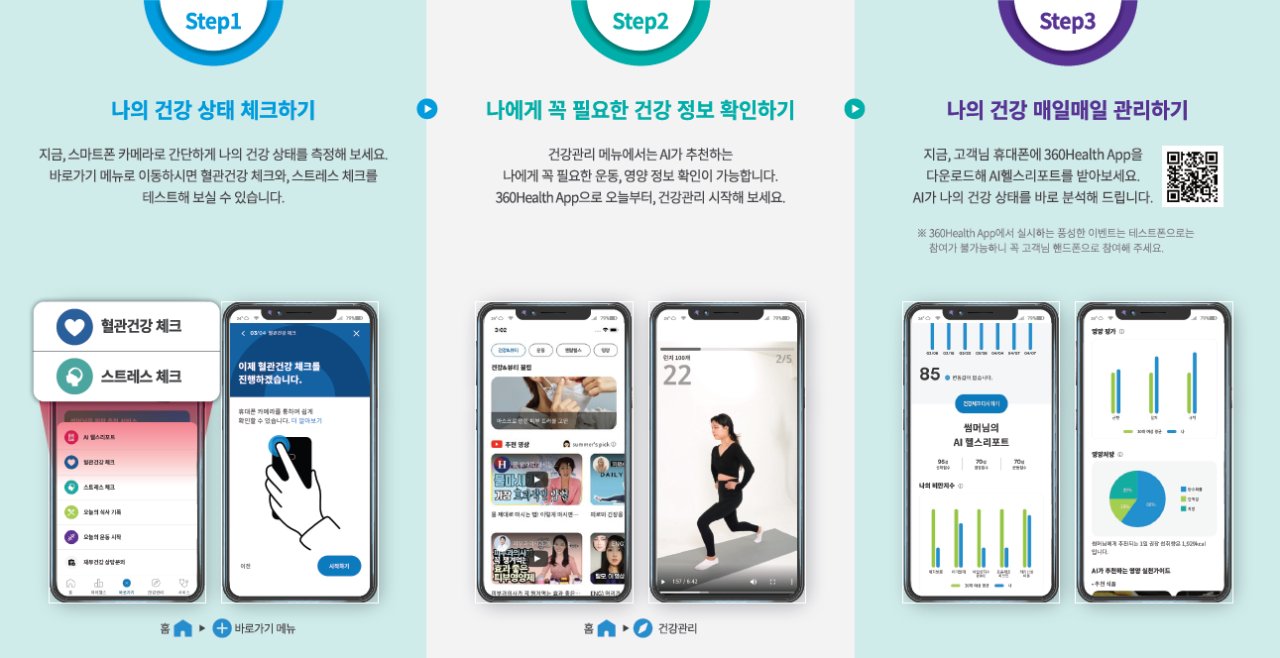

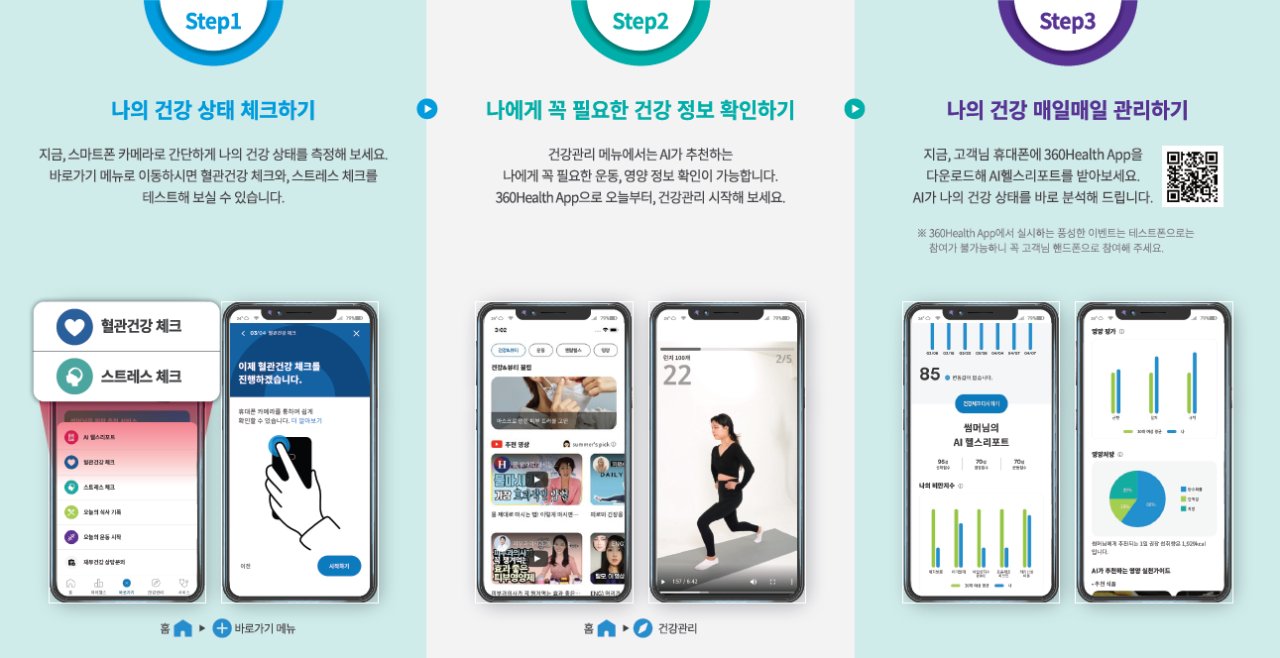

“To give customers easier access to 360Health solution, 360Health App -- an integrated digital health care app – was developed.”

MetLife developed and launched the 360Health solution in 2019 and the 360Health app the following year. The app provides artificial intelligence-based services and access to market-leading health protection products and services, which can help customers navigate the twist and turns of life, according to Kapur. It has hit 200,000 downloads in Korea alone as of June this year.

The app provides customers with weekly AI health reports analyzing physical activity, nutrition intake, and sleep status. This is to give the users health scores, obesity indexes, cardiovascular health risks, and nutritional status. For example, if a user takes a picture of food, then the calories and nutrients are immediately analyzed to see whether it is appropriate for their diet. It also recommends personalized diet and exercise plans based on the accumulated data.

“The research we did a few years ago on people’s views of their future, their retirement, and their health needs, gave us real insight into how customers are thinking today about their tomorrow,” Kapur said.

“One key thing we have learned is that there is an increased focus for people on their ”health span“ – the years of healthy life they want to have. A major role for insurers is to help our customers prepare for and achieve better health span.”

MetLife Asia‘s 2018 survey of 30,000 customers in Korea, China, Japan and Australia showed that 71 percent are now more concerned with their quality of life than how long they live.

Screen capture of MetLife’s 360Health solution app (MetLife Korea)

The app’s digital services are in line with the changes brought on by the COVID-19 pandemic in the insurance sector.

“Insurance consumers‘ expectations for digital services are growing day by day. The tech-savvy generations -- millennials and Generation Z -- are quickly becoming the main target consumer base, and COVID-19 has accelerated the preference for ’contactless services‘ even from older generations.”

Kapur said that, as a result, digital competitiveness has become a major part of customer satisfaction in the insurance industry.

“Insurance customers will compare their digital experiences with services from internet platform giants; therefore, we must continue to innovate to achieve customer satisfaction.”

MetLife Korea, a subsidiary of US insurance behemoth MetLife, entered the market in 1989 and is an industry trailblazer in adopting digital health care services, in this sense, according to Kapur.

MetLife Korea last year became the first life insurance provider in Korea to launch a KakaoTalk-based AI variable insurance fund management service. The company also released the first fixed-term insurance payment service for smartphone devices which requires no paperwork, he added.

(mkjung@heraldcorp.com)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)