(Shinhan Bank)

South Korea’s Shinhan Bank said Tuesday it has completed its review of its cross-border wiring and transfer technology for stablecoins, but remained cautious on its actual adoption.

Stablecoins are a form of cryptocurrency designed to have a stable value tied to traditional government-backed currencies, or to a commodity such as gold, to dodge the volatilities that Bitcoin and other cryptocurrencies have.

“With the stablecoin transactions growing overseas, including JP Morgan’s JPM Coin, we felt the need to review a key related technology to keep pace with the global market and the cross-border transactions service was our first choice,” a Shinhan official said.

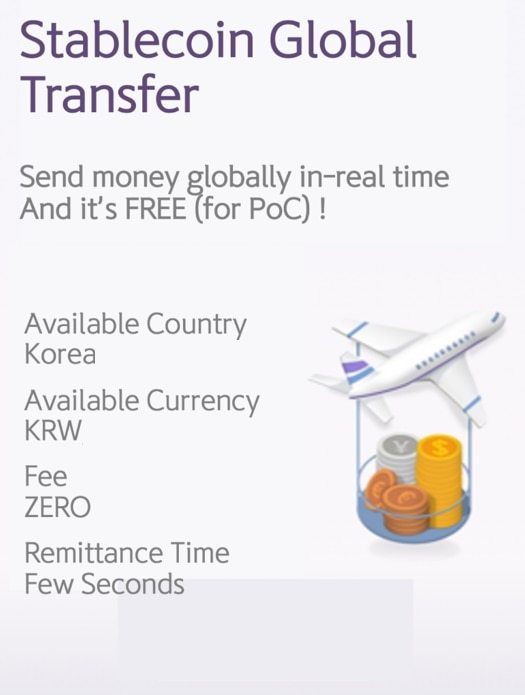

While cross-border cash wiring requires another financial institution as a mediator, around $20 in transaction fees and takes at least two days to complete, a stablecoin transfer is much simpler, Shinhan noted. The stablecoin transaction fee is free, so the user only needs to pay a blockchain network fee of less than 100 won (0.08 won) per wiring and the process takes up some 35 seconds.

But Shinhan remained cautious on its actual adoption, saying that the wiring service, including the cross-border technology, will be launched after reviewing the related frameworks and laws.

Shinhan’s latest move marks a first for a local financial institution in the development of a stablecoin-related technology.

Shinhan announced earlier this month it has preparing to launch its own won-backed stablecoin. The bank plans to ultimately enable the usage of stablecoin in its metaverse platforms, which is also its key project

South Korea has yet to set a solid framework on stablecoins. In the US, regulators have recently expressed their wish to slap bank-like rules on the assets with the issue of whether it should be issued by only insured depository institutions remaining on the table.

Shinhan Bank’s third-quarter net profit gained 21.6 percent on-year to 759.3 billion won, according to a regulatory filing.

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)