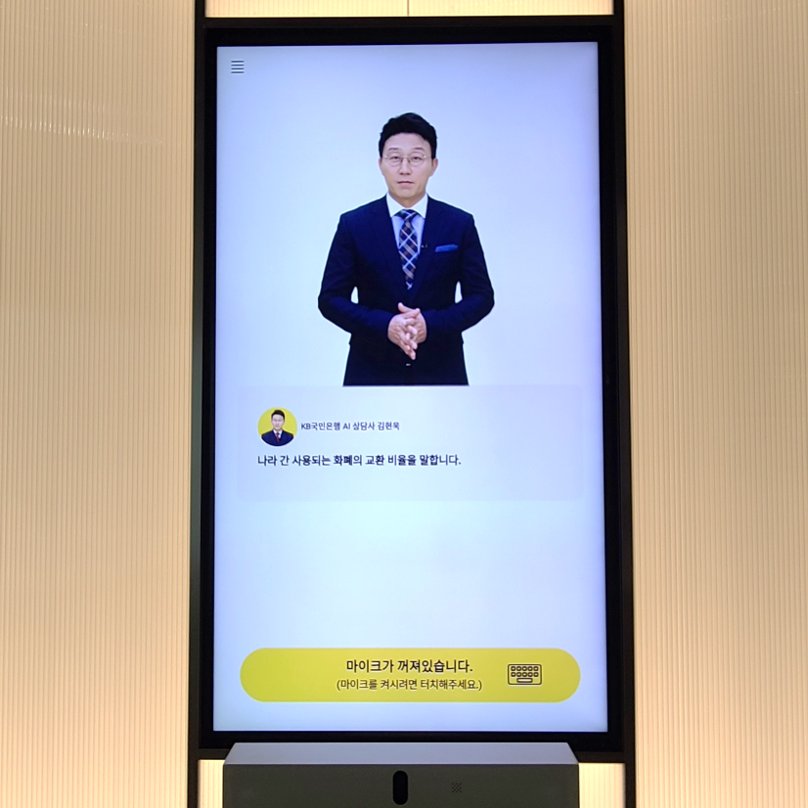

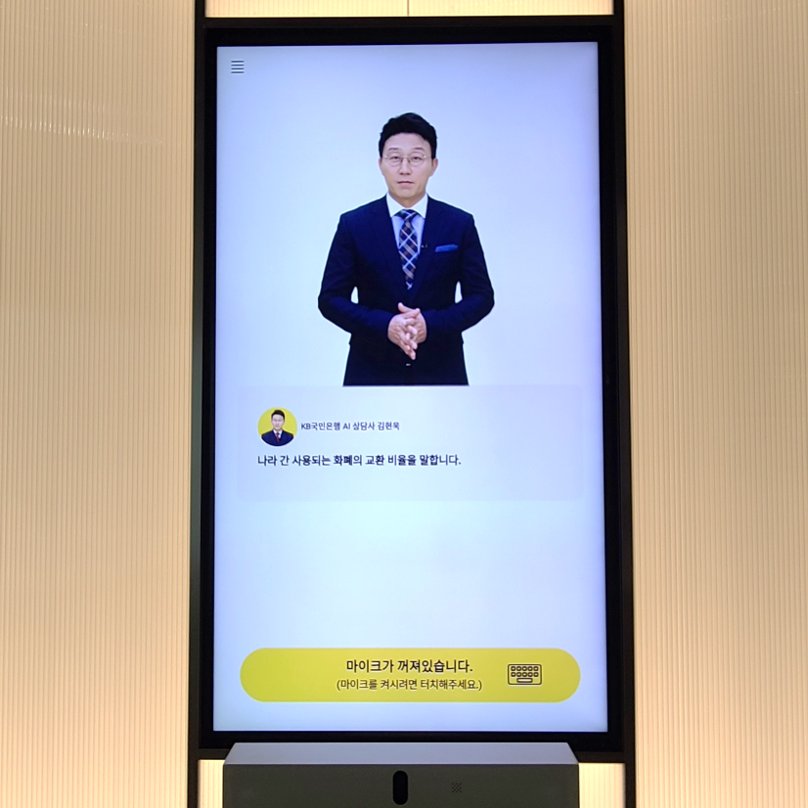

KB Kookmin Bank's AI Banker explains financial information on a monitor at the bank’s headquarters in Yeouido, western Seoul, Wednesday. (Kang Jae-eun / The Korea Herald)

An image of a neatly dressed man welcomes visitors and answers questions on finance services on a monitor at KB Kookmin Bank in Yeouido, western Seoul.

The male character, powered by artificial intelligence and modelled on TV personality Kim Hyun-wook, explains the difference between a debit and a credit card in a tone and manner identical to a real human staffer.

He is a prototype of the AI bankers set to work alongside human bank staff in the near future.

KB plans to test the AI banker service at selected branches starting this fall.

AI bankers will be a growing presence at brick-and-mortar stores, says Chung Hee-ban, the manager of KB Koomin Bank’s department of AI Innovation Platform.

“Our goal is to have AI bankers handle at least half of the work needed at offline branches,” he said.

Since 2019, the bank has been developing the algorithm for its virtual banker with tech startups. The bank also worked with customer service staff to build data to feed the AI.

Currently, the AI banker‘s main role is limited to first-line customer support. At KB, AI bankers will inform customers of available products, services and required documents needed to use a certain service. It can also answer general questions related to finance.

KB is not alone in the digital transformation.

Woori Bank has been forging partnerships with tech companies to develop their own AI bankers. The lender joined hands with graphic technology startup LionRocket in April, and opened a research lab with IBM Korea and telecommunications provider KT in May, to develop an AI banker that looks, speaks and reacts like a real human.

One of its goals, Woori Bank said, is to have AI bankers help senior customers get comfortable with its digital services.

Some banks hope AI bankers can open new opportunities in the “metaverse” -- a collective virtual space where users can interact with others through technology such as augmented and virtual reality.

Shinhan Bank recently put out a tender notice seeking partnerships with companies that can develop an “artificial human” banker. Not only will the AI assist customers in digital banking spaces, but could work for its metaverse branches, the company said.

The race to develop AI bankers is heating up in Korea, especially after the pandemic brought about the closure of hundreds of offline stores nationwide. The market, however, is still in its infancy compared to the leading overseas markets.

HSBC’s locations in the US are already assisted by humanoid robot bankers based on the Pepper robots developed by Softbank. The robot provides basic product information to customers and communicates with bank staff on inquiries from clients.

There are still technological hurdles. KB’s AI banker, for instance, misunderstands certain phrases, and is unable to engage in open-ended conversations.

Despite these limits, investment in AI bankers will continue to grow, says Chung, as there are clear benefits to adding a human touch to technology.

“Even though we already have text-based services -- like chatbots or written explanations on mobile apps -- in place, customers tend to focus more when they have a human-like figure explain the detail in audio,” said Chung.

Experts point out the risk of AI bankers making biased or unethical decisions.

“Since the algorithms that construct an AI banker is developed by individual companies, there’s always the danger of a ‘black box risk’ -- when an AI recommends a certain product or discriminates certain customers over others for unknown reasons,” said Lee Soon-ho, researcher at the Korea Institute of Finance.

The Financial Supervisory Service said in May that it would support AI development in the finance sector and develop big data infrastructure. It would come up with regulations to eliminate the risk of AI bankers mis-selling financial products to customers.

By Kang Jae-eun (

kang.jaeeun@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)