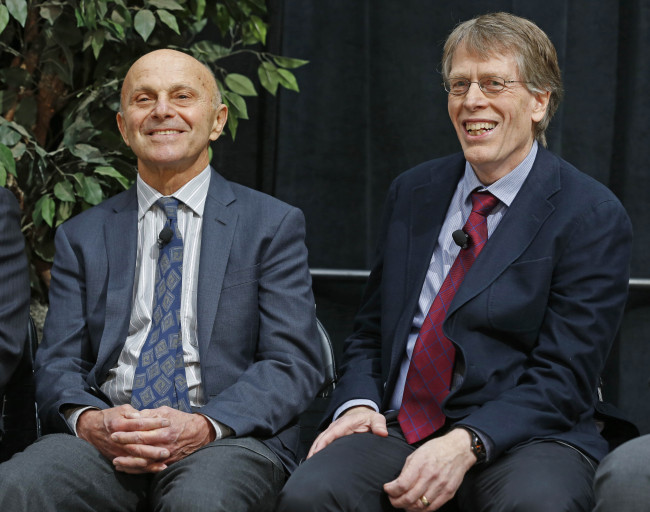

Nobel Prize winners Eugene Fama (left) and Lars Peter Hansen of the University of Chicago (AP-Yonhap News)

The Victorian historian Thomas Carlyle called it the “dismal science,” but one of a trio of American economists awarded the Nobel Prize in economics on Monday said he believes it has broad applications to improving human welfare.

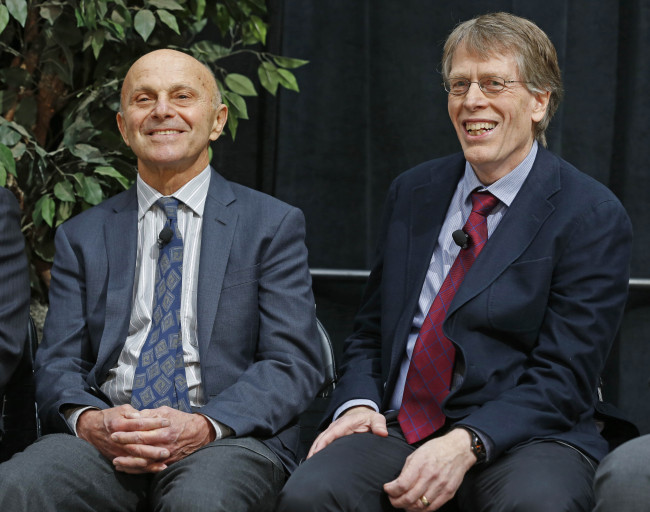

“Finance drives modern civilization,” said Robert J. Shiller. “I want to see finance developed further to benefit mankind.”

Shiller of Yale University, along with Eugene F. Fama and Lars Peter Hansen of the University of Chicago, received the Nobel Prize in economics “for their empirical analysis of asset prices,” the Nobel committee said Monday.

According to the Nobel committee, their research “laid the foundation for the current understanding of asset prices.” Now, asset prices can be predicted in broad terms and over longer periods, such as 3-5 years, on account of their research.

Economist, author and Yale University professor Robert Shiller (AP-Yonhap News)

Shiller had warned about the 1990s-era “stock bubble” and about high home prices before the decline in housing values that greatly contributed to the recession from which the U.S. economy continues its slow recovery. The award comes five years after a financial crisis that drove the United States and world economies into their deepest recession since the Great Depression.

Shiller said the 2008 financial crisis “reflected mistakes and imperfections in our financial system that we are already working on correcting. I think there’s much more to be done. I think it will take decades. But we have been through financial crises many times in history and we generally learn from them.”

Spanning decades, the work of the three Americans was at times contradictory.

Shiller took issue with Fama’s basic argument that investors are always logical and markets efficient, using the phrase “irrational exuberance” to explain run-ups in asset prices.

Born in Detroit in 1946, Shiller earned his Ph.D. in economics from the Massachusetts Institute of Technology in 1972.

Since 1981, Shiller has been at the vanguard of economists chipping away at the theory of efficient markets. His research showed that investors can be irrational and that assets from stocks to housing can develop into bubbles.

The economics award was not among the original prizes created in 1895 by Swedish industrialist Alfred Nobel to honor work in physics, medicine, chemistry, literature and peace. The Central Bank of Sweden added it as a category in memory of the industrialist. The first prize was awarded in 1969.

By Philip Iglauer (ephilip2011@heraldcorp.com)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)