As General Motors Co. Chief Executive Officer Dan Akerson works on a global corporate reorganization, the decisions he faces are playing out in one of the company’s most important emerging markets: Brazil.

The automaker is evaluating how it will structure management in the country after the former president of GM Brazil, Grace Lieblein, switched to head of global purchasing in December. GM is holding off on replacing her as it determines what kind of role the person will have, said Jaime Ardila, president of GM South America.

Akerson, through the revamping, is pushing to increase accountability and flexibility as the U.S. automaker slugs it out globally with Toyota Motor Corp. and Volkswagen AG. Among the choices he faces is whether one person in a country such as Brazil will oversee all operations or whether the top executive might be the country’s Chevrolet chief.

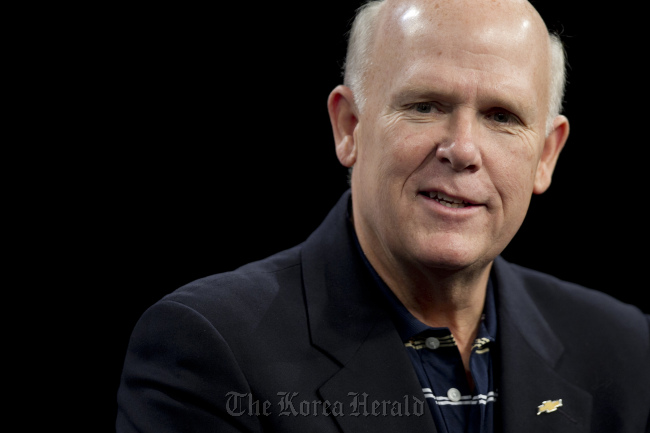

General Motors CEO Dan Akerson

GM is “right in the middle of the discussion” about how the reorganization will work, Ardila said in an interview last week in Detroit. “We’re going through some important reorganization generally, you know, with all of this emphasis on global brands.”

For now, Ardila is overseeing Brazilian operations in addition to his duties running GM South America. This week GM combined the chief financial officer roles for Brazil and South America, naming Carlos Zarlenga to the position.

GM introduced seven new vehicles in Brazil last year as part of an effort to update its offerings and return the region to profitability. Brazil accounted for 60 percent of GM’s vehicle sales in South America during the first three quarters of last year.

The company has five divisions, including its finance arm. North America generated the most profit last year while the international operations group, which includes China, saw the fastest sales growth. Europe has lost $17.3 billion since 1999 through 2012’s third quarter.

Some level of geographic organization is inevitable, even as management focuses more on brands, Ardila said.

“South America as a cluster isn’t going to disappear,” he said. “You’ll always have to have the cluster because of demographics, market preferences, culture, economic conditions, ― it’s a natural cluster.”

While Ardila didn’t discuss the company’s other regions, he said Detroit-based GM has a history of organizing its operations by brands.

“This company was divided by brands for many years,” he said.

GM moved away from North American operations being divided around Chevrolet-Pontiac-GMC and Cadillac-Buick-Oldsmobile brands in 1992 as part of a reorganization by then-Chairman Robert Stempel billed as a “streamlining.”

Akerson, who replaced Ed Whitacre as CEO before the automaker’s November 2010 initial public offering, is working to refocus management around brands and global functions. He created a position of the head of the Cadillac brand globally in October and chose Bob Ferguson, who had been GM’s top lobbyist.

Other jobs with worldwide responsibilities include Lieblein’s purchasing role; Mary Barra as head of global product development; and Tim Lee as head of global manufacturing along with leading international operations.

While Akerson is planning a global structure for Chevrolet similar to the Cadillac position, the CEO said in October that he didn’t feel the same “immediacy” to fill it as he did for the luxury brand.

A priority for Akerson over the past year has been his push for updates to the company’s managerial accounting and information technology systems to allow for better financial transparency and communications.

The new systems should help Akerson drive accountability and change at the automaker. He has expressed frustration about the company’s splintered fiefdoms and culture of slow-moving consensus.

In particular, the new accounting system allows for GM executives to get a better idea of profitability on a country- by-country basis.

“We’re going to have better information to help everybody understand exactly where we’re making profits and how to make better decisions about vehicles,” Barra said last week in an interview. She said it’s “a little too soon” to give concrete examples.

(Bloomberg)

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)