SEJONG -- The Moon Jae-in administration has continued to push for “income-led” growth by raising the minimum wage and scaling back the workweek.

This was aimed at boosting consumption by raising the disposable income of low-income households. This in turn was meant to boost growth in the overall economy.

But drastic hikes in the minimum wage had side effects, as small and midsized businesses took a conservative stance toward hiring due to higher labor costs, which have been linked to higher unemployment rates.

In addition, a large portion of small firms including those run by the self-employed have closed their businesses.

This has resulted in worsening income polarization over the past two years.

The number of self-service gas stations and self-service payment retail markets have increased in Korea in the wake of steep hikes in the minimum wage. (Yonhap)

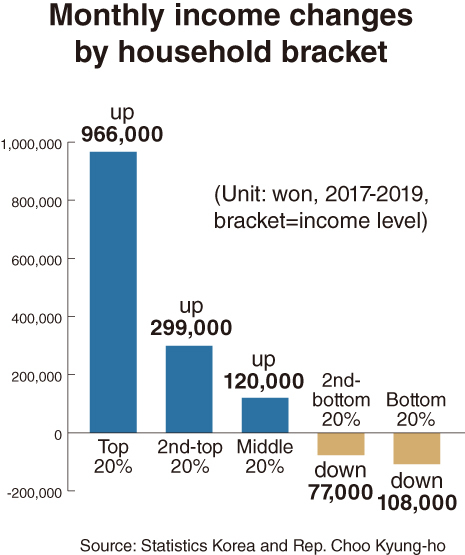

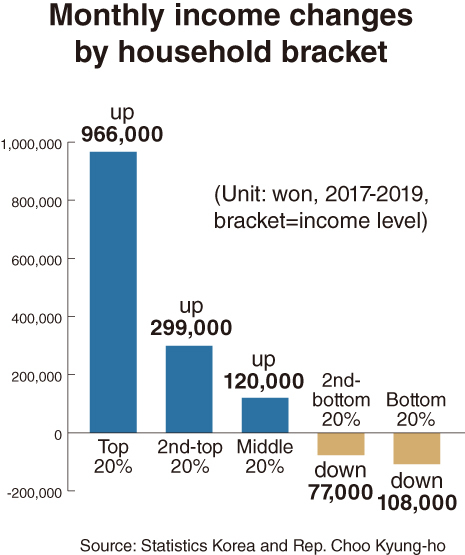

According to an opposition party lawmaker’s research on data from Statistics Korea, the top 20 percent of total households, based on income level, saw their monthly earnings increase by an average of 966,000 won ($809) over the past two years.

Their average income climbed to 8.59 million won as of the second quarter of 2019, up 12.7 percent from 7.63 million won in the second quarter of 2017.

Income for the second-highest 20 percent of households also rose by 299,000 won from 4.57 million won to 4.87 million won. And income for the middle 20 percent inched up 120,000 won to 3.29 million won.

In contrast, the average monthly income for the bottom 20 percent of households fell by 108,000 won in the corresponding period -- from 790,000 won to 682,000 won.

Likewise, households belonging to the second-lowest 20 percent, saw their earnings decrease by 77,000 won from 1.924 million won to 1.847 million won.

Rep. Choo Kyung-ho of the Liberty Korea Party said the income drop among the bottom and second-lowest 20 percent can be attributed to the worsening situation in the job market and for self-employed businesses. His remarks indicate that the low-income bracket -- bottom and second-lowest 20 percent -- suffered either a drop in wages or self-employed business earnings.

“Despite the government’s expansion of its welfare policy, the income of low-income households declined in the wake of side effects from the economic policy failure,” Choo said, calling for the administration to scrap the wage-led policy immediately.

(Graphic by Han Chang-duck/The Korea Herald)

Furthermore, such disparity is also seen in the business sector.

Data from the Bank of Korea showed that conglomerate business units saw their ratio of operating profit to sales reach 8.39 percent in the third quarter of 2018, an on-year increase of 0.51 percentage point. This is its highest level since the central bank began compiling related data.

On the contrary, the operating profit-to-sales ratio of SMEs stood at 4.13 percent, down 2.48 percentage points from a year earlier, posting a record low. As a result, the profitability polarization between large firms and SMEs has widened to an all-time high.

The gap was also found to have worsened in payments to employees.

During the first 10 months of 2018, monthly wages for conglomerate employees averaged 5.3 million won, according to the Ministry of Employment and Labor.

In contrast, SME employees earned only 3 million won -- a difference of 2.3 million won.

For the same period in 2016, the corresponding wages were 4.9 million won among conglomerates and 2.7 million won among SMEs -- a difference of 2.18 million won.

Meanwhile, an analyst in Seoul pointed out that heavy debt -- not salaries -- is hampering consumption.

The ratio of household debt to disposal income in Korea has grown rapidly in the past few years and is heading toward the 200 percent mark, which means debt doubles disposable income.

After topping 150 percent in 2010 and 180 percent in 2016, the debt-to-disposal income ratio in South Korea’s household sector posted 185.88 percent at the end of 2017, according to the Organization for Economic Cooperation and Development.

Korea ranked seventh in terms of household debt risks among 35 countries researched out of the 36 OECD members.

By Kim Yon-se (kys@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)