SEJONG -- The South Korean won has lost ground against “reserve currencies” such as the euro and the Japanese yen over the past month, in addition to the US dollar.

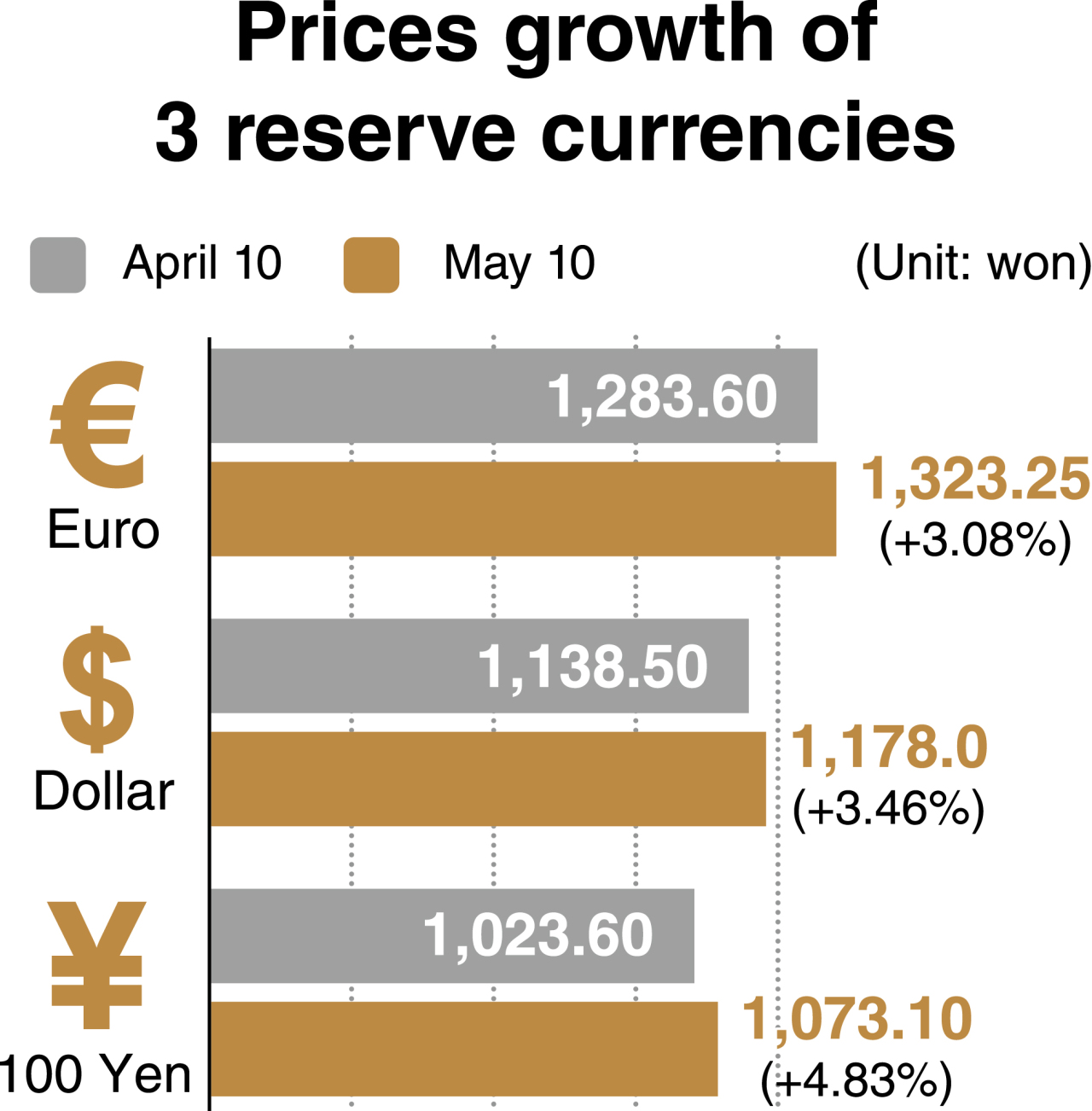

The euro was worth 1,323.25 won as of May 10, 2019, up 3.08 percent (or 39.65 won) from 1,283.60 won on April 10. That’s the euro’s strongest position in seven months, ever since it recorded 1,323.35 on Oct. 11, 2018.

(Graphic by Heo Tae-seong/The Korea Herald)

The Korean currency also showed weakness vis-a-vis the Asian reserve currency, the yen. The Japanese currency had climbed to 1,073.10 won per 100 yen as of May 10, up 4.83 percent from 1,023.60 won a month earlier.

Over the corresponding period, the US greenback posted a 3.46 percent increase to close at 1,178.0 won, as compared with 1,138.50 won on April 10.

“More participants in the international capital market have recently relocated their investments to safe assets like key currencies led by the dollar, switching from their earlier stance of preferring risky assets like stocks on emerging markets,” said a foreign exchange analyst in Yeouido, Seoul.

He said the cheap won was the unavoidable result of global uncertainties stemming from commerce conflicts between the US and China. Low interest rates in Korea, under 2 percent, have accelerated its plunge in value, he added.

Some analysts are of the opinion that the Bank of Korea’s monetary policies over the past few years, heavily oriented toward quantitative easing, have left the central bank with little room to maneuver. They say the BOK should have kept pace with the US Federal Reserve in raising the benchmark rates.

“The weak won, in the aftermath of a series of rate cuts since 2014, (leaves Korea) susceptible to capital flight during situations in which investors prefer safe assets to risky assets,” one analyst said. “Further, it is not easy for the BOK to push for rate hikes, from now on, to block a capital outflow due to the sluggish domestic economy.”

He said major indices -- the weak currency, the recent spike in gasoline prices and low interest rates -- could give rise to pessimism about the nation’s growth potential for the time being.

If the current situation persists, enterprises could encounter a significant cost burden as import prices surge and raw materials become more expensive, possibly depressing profitability. This portends a capital outflow, a situation where inbound investors pull out of the country.

A Konkuk University professor was quoted by a news outlet as saying that “to ensure the stability of (won-dollar exchange rates), it is necessary for the BOK to set aside sufficient foreign exchange reserves.”

But “when the won loses ground, the bank has no choice but to buy (secure) dollars by issuing bonds. The bond issuance is backed by taxpayers’ money, which places a burden on the overall economy,” he said.

Some senior officials at the Finance Ministry and the BOK downplayed worries over the unfavorable indices and prospects for their continuation.

A commercial bank employee in Seoul counts batches of $100 bills. (Yonhap)

Last week, the Land Ministry announced two more locations for the third wave of “new towns,” residential areas full of new housing developments to be built in satellite cities in Gyeonggi Province. While the government said the objective of its new town projects was to stabilize apartment prices in Seoul, some real estate market insiders think the real goal is to shore up the economy by vitalizing the construction sector.

The Land Ministry was scheduled to make the locations public as early as this June, but decided to advance the date of its announcement.

For the BOK, a rate hike could undermine the government’s efforts to reinvigorate the economy.

But conversely, supporting the government’s efforts by means of a rate cut would be risky amid recent hawkish remarks from the US Fed. While the US base rate has climbed to 2.25-2.5 percent per annum, Korea’s rate has remained low at 1.75 percent.

“The central bank is in a double bind,” said a research fellow, calling it “lamentable” that the BOK’s monetary policy committee might feel compelled to go ahead with another freeze the next time it is called upon to set rates.

The central bank’s seven rate-setters, including BOK Gov. Lee Ju-yeol, are next scheduled to meet May 31.

In the US, the Federal Open Market Committee is slated to decide its next base rate target June 18-19.

The BOK is not scheduled to set any new rates in June, but will hold another monetary policy committee meeting July 18.

By Kim Yon-se (kys@heraldcorp.com)