Concerns over the possibility of capital outflow amid a widening gap between interest rates in Korea and the US are being eased by the strengthening of the won against the dollar.

Earlier this month, the Bank of Korea held steady its key rate at 1.5 percent despite a decision by the US Federal Reserve in March to raise its policy rate by a quarter percentage point to a range of 1.5 percent to 1.75 percent.

A weakening increase in consumer prices, growing household debt and worsening conditions for exporters have left BOK policymakers cautious on additional rate hikes.

Analysts expect the central bank to raise its base rate by a quarter percentage point once this year, probably in July.

A pedestrian walks past KEB Hana Bank headquarters located in Seoul in a photo taken on March 30 after the market closed. (Yonhap)

This would further widen the rate gap with the US, as the Fed is likely to make at least two more rate hikes within the year on the expectation that the world’s largest economy will continue to grow robustly and see inflation reach the 2 percent target in the coming months.

Market watchers say there is little possibility of massive capital outflow in the near term, but an interest rate gap beyond 0.75 percent could pose a severe downside risk to local equity markets.

What gives the BOK some room to slow the pace of raising rates is the strengthening of the Korean currency against the greenback in recent months.

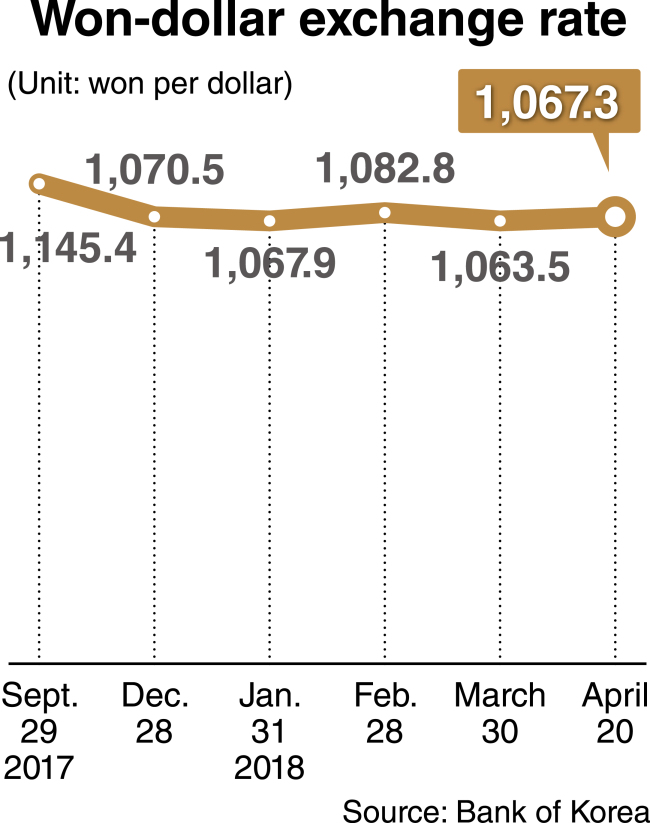

The value of the won against the dollar gained 0.7 percent on-quarter in the first three months of the year, closing at 1,063.5 won per dollar in the Seoul foreign exchange market on March 30, according to BOK data.

The increase marked the seventh highest among the currencies of Group of 20 major economies over the cited period.

The credit default swaps premium for government-issued foreign exchange stabilization bonds stood at 49 basis points in March, down from 52 basis points a month earlier.

The won strengthened further to 1,056.6 won per dollar on April 2 before weakening somewhat to move in the 1,060 won range in the past couple of weeks.

The won seems set to continue to appreciate against the dollar, as geopolitical tensions on the Korean Peninsula are expected to be eased following the upcoming summitry on dismantling Pyongyang’s nuclear arsenal and Seoul is moving to reveal records on its interventions in the currency market.

Some analysts forecast that the won-dollar exchange rate will fall below 1,000 won in the year to come.

“Though interest rates have been reversed between Korea and the US, what is different from the past cases is the continuous strengthening of the won,” said Kim Hyung-ryeol, an analyst at Kyobo Securities.

He said the rising value of the won was offsetting the gap in interest rates.

In March, foreign investors turned to net buyers on the local stock market, unaffected by the US rate hike, as they looked to the strengthening won and improved corporate earnings.

Foreigners purchased a net 123 billion won ($115 million) worth of Korean shares last month, compared with the net selling of 3.96 trillion won a month earlier, according to figures from the Financial Supervisory Service.

Offshore investors also bought a net 3.66 trillion won worth of local bonds in March, extending their buying streak for a third consecutive month.

Seoul has been pressed by the US and the International Monetary Fund to make public the records on its interventions in the exchange market to enhance the transparency of its currency policy.

A biannual report released by the US Treasury Department earlier this month stopped short of designating Korea as a currency manipulator, placing it on a monitoring list for a fifth consecutive time along with five other countries.

But the report urged Seoul to disclose details of its exchange market interventions quickly in a “transparent and timely manner.” It estimated that Korean authorities made a net purchase of $9 billion of foreign exchanges, or 0.6 percent of the country’s gross domestic product, in 2017 to hold down the won’s appreciation.

Seoul officials reportedly want to reveal the net purchase of foreign exchanges every six months to leave less room for speculators disrupting the local currency market, while the US appears to be asking them to disclose the total amounts of purchases and sell-offs at a shorter interval.

Finance Minister Kim Dong-yeon discussed measures to improve the transparency of Korea’s exchange market with US Treasury Secretary Steven Mnuchin and IMF chief Christine Lagarde during their meetings in Washington last week.

A continuous appreciation of the won would significantly weigh on the country’s exports, which have shored up its growth amid sluggish domestic consumption.

Asia’s fourth-largest economy saw its outbound shipments increase 6.1 percent on-year to $51.58 billion in March, rising for a 17th consecutive month. Brisk sales of memory chips and petrochemical products helped boost overall exports, with local shipbuilders and automakers struggling with weak demand.

A study by the Hyundai Research Institute, a local think tank, estimated a 1 percent rise in the value of the won against the dollar would result in reducing Korea’s exports by 0.51 percent.

Experts also caution against the possibility that the country will be hit by capital outflows if the rate gap between Korea and the US continues to widen with the Federal Reserve expected to raise rates up to eight times through 2020.

BOK Gov. Lee Ju-yeol told reporters earlier this month the recent inflow of foreign capital could not be seen as significant, noting bonds bought by foreign investors mostly carry short-term maturities.

By Kim Kyung-ho

(

khkim@heraldcorp.com)