Chinese nationals have been increasingly making inroads into the expensive real estate market in Seoul and its surrounding cities, but the move will not be powerful enough to drive up the overall home prices, experts said.

According to data by the Seoul Metropolitan City, the number of land lots owned by Chinese nearly doubled to 4,139 in the first half of this year from 2,113 at the end of 2014.

By land size, property owned by Chinese nationals rose 29 percent to 171,600 square meters from 133,500 square meters.

Over the same period, land lots owned by US citizens in Seoul only rose 1 percent, while those by Japan fell 3.4 percent.

By region, Chinese property investment in Korea is spreading from southern island Jejudo to sporadic districts in the Seoul metropolitan area including southern Seoul of Gangnam, Hapjeong in northwestern Seoul and Yeongjongdo and Songdo near Incheon, according to Park Won-gap, head researcher for real estate at KB Kookmin Bank.

“Chinese are buying up Korean property because of the geographical benefits for temporary residency and expected profits from leasing commercial buildings. And the demand will keep increasing down the road,” Park told The Korea Herald. Beijing is three hours away from Seoul by flight.

“However, it’s not going to be big enough to become a major drive for price hikes. The Korean case is different from the Canadian one.”

Park was referring to the Canadian government’s recent crackdown on Chinese speculative home buyers, slapping a 15 percent transfer tax on foreign nationals who buy real estate in the Metro Vancouver area.

Not only Canada but Australia, the UK and Ireland have also suffered record home price spikes due to surging demand from China, as Chinese people have sought for stable sources of cash outside the mainland amid slowing local economic growth.

The majority of Korean real estate market is still based on “jeonse,” which makes it difficult for the Chinese investors to penetrate the local housing market, Park noted. Jeonse refers to Korea’s unique two-year contract between a landlord and a tenant with a lump-sum rental deposit, without an additional monthly payment.

Even though the property market is gradually moving toward monthly payments, it is not likely that the jeonse system will go away in the near future, he said.

Another factor limiting Chinese investment is the geographical risk coming from North Korea, Park said.

“Unless the security risk stemming from the confrontation between the two Koreas diminishes, there will not be an inflow of Chinese nationals purchasing real estate here for permanent residency.”

Ham Young-jin, head of research center at housing market information provider Real Estate 114, shared Park’s view.

She added that the Korean government’s giving permanent residency to foreign real estate investors is partly conducive to attracting foreign capital. She said any policy curbing Chinese people from investing more in Korea may discourage foreign capital from inflow into the Korean economy.

“Some of Chinese people invest here for residency in their post-retirement life. Except for Jeju, policymakers shouldn’t have to consider curbing the real estate investment by foreigners,” Ham said.

In 2010, the government introduced a “real estate investment immigration program,” giving residency to foreign nationals who invest more than 500 million won in Korean real estate. Since then, the number of visas in relation to real estate investment explosively increased to 4,019 in June from 229 in June, 2012, according to a report by the National Assembly Research Service. Out of 4,019 cases, 99 percent were given for residency on Jeju.

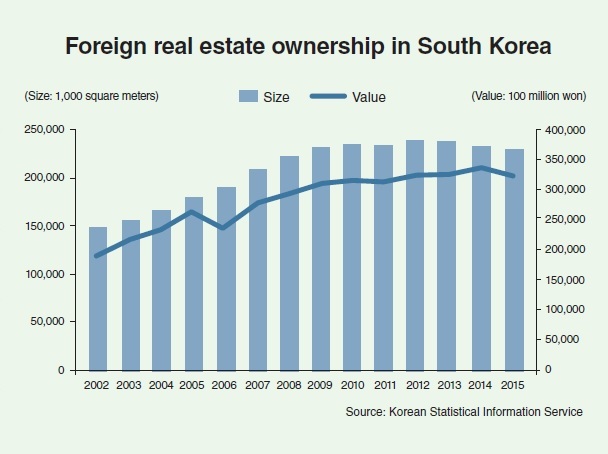

Nationwide, local property owned by foreigners reached 228 million square meters in size and 32.7 trillion won in value, as of the end of 2015.

By nationality, the US came first taking up 51 percent of the foreign-owned property, followed by Europe with 10 percent, Japan with 8 percent and China with 6 percent.

By purpose of use, forest or farmland was the largest with 60 percent, followed by sites for factories with 28 percent, for leisure, 5 percent, and for residence, 5 percent, the report showed.

Meanwhile, the rising presence of Chinese nationals in the real estate and local economy of Jeju has been sparking concerns such as of insufficient regulations to manage any reckless development.

According to data provided by the Jeju Special Self-governing Province to People’s Party’s Rep. Lee Yong-ho earlier this month, Chinese nationals have been the most aggressive in buying properties in the island. The size of land lots owned by Chinese jumped by 6.9-fold from 1.42 million square meters in 2011 to 9.75 million square meters as of August this year. Of the 1,704 accommodation facilities purchased by foreigners as of June, 93 percent belong to the Chinese.

By Kim Yoon-mi

(yoonmi@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)