WASHINGTON (AFP) ― Billionaire investor Warren Buffett announced Saturday that a successor has been chosen to lead his Berkshire Hathaway holding company, although he did not identify the person.

Buffett, 81, wrote in a letter to investors that Berkshire Hathaway’s board of directors chose his successor and two back-up candidates.

“When a transfer of responsibility is required, it will be seamless and Berkshire’s prospects will remain bright,” Buffett wrote.

“Do not, however, infer from this discussion that Charlie and I are going anywhere,” Buffett said, referring to the firm’s Vice Chairman Charlie Munger, who is 88.

“We continue to be in excellent health and we love what we do.”

The company’s closely watched investment portfolio has significant holdings in the railroad, retail and utility industries.

It allayed some concerns about succession by recently hiring two hedge fund managers, Todd Combs and Ted Weschler.

Buffett said that “each will be handling a few billion dollars in 2012, but they have the brains, judgment and character to manage our entire portfolio when Charlie and I are no longer running Berkshire.”

In the same report, Berkshire Hathaway said its net earnings fell sharply in 2011 but its financial performance still beat the Standard & Poor’s 500 on the New York Stock Exchange.

The company’s annual net income totaled $10.3 billion, or 21 percent less than in 2010 but 27 percent more than in 2009, according to its annual report published online.

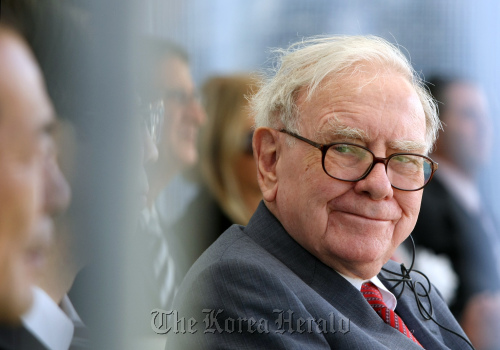

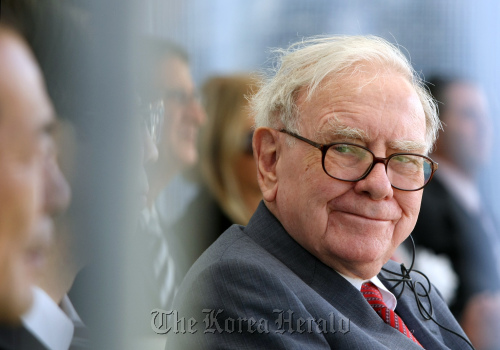

Warren Buffett, chairman and CEO of Berkshire Hathaway Inc. (Bloomberg)

Buffett prefers to measure his company’s performance by changes in its net book value, which assesses gains or losses for shareholders.

Net book value grew by 4.6 percent in 2011, far less than the 13.0 percent increase in 2010, Berkshire Hathaway reported.

Nevertheless, the increase was greater than the S&P 500 for the first time since 2008 by 2.5 points, the holding company reported.

Berkshire profit declines 30%

Berkshire Hathaway Inc. said fourth- quarter profit fell 30 percent on smaller gains from Warren Buffett’s portfolio of derivatives.

Net income declined to $3.05 billion, or $1,846 a share, from $4.38 billion, or $2,656, a year earlier, Omaha, Nebraska-based Berkshire said today.

Buffett, Berkshire’s chairman and chief executive officer, is investing in stocks and acquisitions as Berkshire generates earnings. The derivatives bets, made in prior years on long-term gains stocks and the solvency of borrowers, produced more than $2 billion of earnings in the fourth quarter of 2010.

“These are contracts that don’t expire for another 10 or 15 years and might fluctuate a lot every quarter,” said David Kass, a professor at the University of Maryland’s Robert H. Smith School of Business. Buffett is “not really bothered by the volatility short term,” said Kass, in an interview before results were released.

Berkshire has slumped 4 percent in New York in the last 12 months, compared with a gain of 4.6 percent for the Standard & Poor’s 500 Index.

Buffett sold the equity derivatives to undisclosed buyers for $4.9 billion. The contracts, known as puts, are tied to four stock indexes, including the S&P 500 and the Nikkei 225 Stock Average. Liabilities narrow when the indexes rise and widen when they fall, and the fluctuations are recorded each quarter in Berkshire’s income statement.

(Bloomberg)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=645&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)